In the realm of personal finance, a high credit score is the golden key that unlocks doors to lower interest rates, better loan terms, and improved financial opportunities. For nurses and healthcare professionals who dedicate their lives to caring for others, it’s crucial to also prioritize their own financial well-being. This blog post is a comprehensive guide that not only explains the significance of a strong credit score but also unveils essential credit card hacks and cashback strategies tailored for nurses, helping them achieve a credit score of 800+.

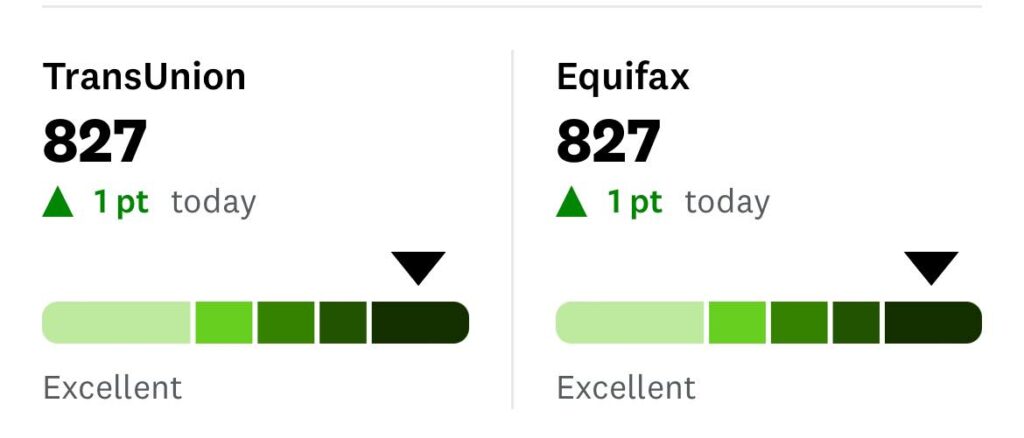

I finally hit my 800+ Credit score as a nurse – after many years of struggling with credit card debt.

Understanding Importance of Credit Score

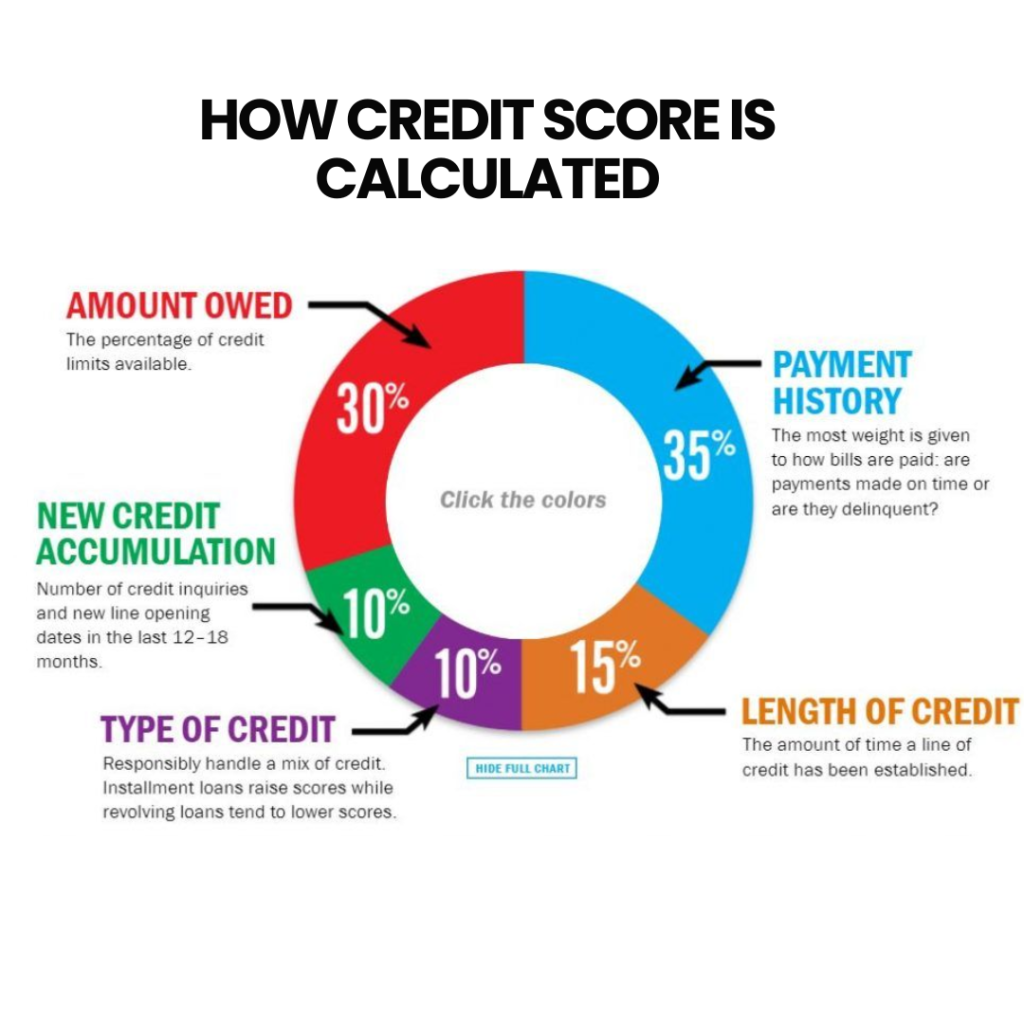

Your credit score is a numerical representation of your creditworthiness, indicating how likely you are to repay borrowed funds. Ranging from 300 to 850, a higher credit score reflects responsible financial habits and makes you an attractive borrower to lenders. Here’s why a good credit score is vital:

- Lower Interest Rates: A high credit score can lead to significantly lower interest rates on loans, saving you thousands of dollars over time.

- Better Loan Terms: Lenders offer more favorable loan terms, such as longer repayment periods and higher borrowing limits, to those with excellent credit.

- Enhanced Financial Opportunities: A strong credit score opens doors to premium credit cards, rental applications, and even potential employers who may check your credit history as part of the hiring process.

Hacks to Increase your Credit Score

- Pay on Time, Every Time: Timely payment of credit card bills is the foundation of a good credit score. Set up automatic payments or reminders to ensure you never miss a due date.

- Keep Credit Utilization Low: Aim to keep your credit card balances well below their limits, ideally below 30%. This showcases responsible usage and boosts your score.

- Diversify Your Credit Mix: A mix of different types of credit (e.g., credit cards, mortgages, loans) can positively impact your credit score. However, only apply for credit when needed to avoid unnecessary inquiries.

- Be Cautious with New Accounts: Opening multiple new accounts in a short period can lower your average account age and slightly impact your score. Space out new applications strategically.

Utilizing Cash Backs and Credit Card Points

Nurses can leverage their spending patterns to maximize cashback rewards and optimize their financial gains:

- Healthcare Category Cashback Cards: Look for credit cards that offer bonus cashback rewards for healthcare-related expenses. Many cards provide extra cashback for purchases made at pharmacies, hospitals, and medical supply stores.

- Grocery and Dining Cashback: Nurses often have busy schedules. Opt for credit cards that offer elevated cashback rates on grocery and dining expenses, helping you save on everyday essentials.

- Flexible Rewards for Travel: If you enjoy traveling, consider cashback cards that allow you to redeem rewards for travel expenses. These can be particularly advantageous for nurses seeking well-deserved getaways.

- Rotating Category Cashback Cards: Some credit cards rotate their cashback categories every quarter. Take advantage of these rotating offers by aligning your spending with the featured categories.

Related: Read 7 Tips to Use Credit Card Wisely

In conclusion, a credit score of 800+ is not an unattainable goal, and nurses can employ these credit card hacks and cashback strategies to their advantage. A solid credit score doesn’t just benefit your financial life; it also reflects the responsible and diligent attitude that nurses exhibit in their profession. By understanding the importance of good credit and implementing these strategies, nurses can secure a brighter financial future while continuing to make a positive impact on the lives of others.