I often get asked this question. Ellaine, should I hire a financial advisor? Can I hire you?

First of all, I am not a certified and licensed financial advisor. What I do in this blog is provide education so you can make the decisions for yourself including the decision of whether you can just DIY invest on your own, hire a robo-advisor or financial advisor. Or what even is the difference with all these three methods.

If you are reading this article, you are probably wanting to start investing or have started and now trying to answer the question of HOW.

How do you invest? How involved do you want to be with investing?

There are 3 choices for you:

1) to invest on your own,

2) to give your money to an automated investing company, known as a “robo-advisor,”

3) to hire a full-service financial advisor.

But what are the differences between these three methods?

Self Directed or DIY is meant for more seasoned investors who have made an investment in the knowledge of how the stock market works which is hope is YOU. They are comfortable choosing investments and executing trades. It requires zero fee except for time to learning about investing.

Robo-Advisors is for people who want to invest, but are not interested in learning the intricacies of creating or managing and investment portfolio. Robo-advisors are services that use computer algorithms to build and manage a client’s investment portfolio and require very minimal human interaction.

Professionally Managed (Financial Advisor) For investors who want personalized investment strategies that align with other financial goals. When choosing a financial advisor, make sure that they are fiduciary advisors so they always have your best interest in mind when helping you with your finances.

Should You Manage Your Own Portfolio?

When you start to invest your money, your first decision is whether you want to do it yourself or want to outsource it. There is definitely nothing wrong with choosing one or the other.

Investing on your own offers a lot of flexibility and opportunities. You’ll avoid paying fees, and if you do your homework, you’ll probably end up investing your money in basically the same way they’d do for you. You get to pick your own investments whether you decide to invest in target-date funds or index funds.

READ: Top 5 index funds to invest on

You can be an active investor or passive investor depending on your risk tolerance. The only drawback with this method is that you have to be well educated about investing and it’s intricacies and also the tax implications of your investments.

What Is a Robo-Advisor

Around 2010, robo-advisors emerged as a new way to invest. Robo-advisors provide investment guidance through computer generated algorithms and the rates are much cheaper compared to hiring a financial advisor.

Typically, you fill out a questionnaire focused on things like your age, income and retirement goals. The robo-advisor then recommends a pre-built diversified portfolio based on that information. The portfolios typically include low-cost exchange-traded funds (ETFs) and bonds. They’re designed to be stable and long term and will get you into the right mix of investments. This is perfect if you are just accumulating your assets and don’t have a complex financial situation like (having a lot of money to invest, owning a business, retiring early)

What Is a Financial Advisor

A financial advisor is a professional who can give you advice and guidance on anything related to your finances — not just investing. Financial advisors come from a wide range of educational backgrounds and sometimes have other titles, but you want a Certified Financial Planner (CFP). They are bound by fiduciary duty meaning they are legally obligated to give advice that will help you out the most.

In addition to financial planning, they also provide sound tax advice and estate planning.

You probably don’t need a financial advisor if you’re just starting out. Not only do they charge a large deposit, but the annual fees for financial advisors is 1% of your investments.

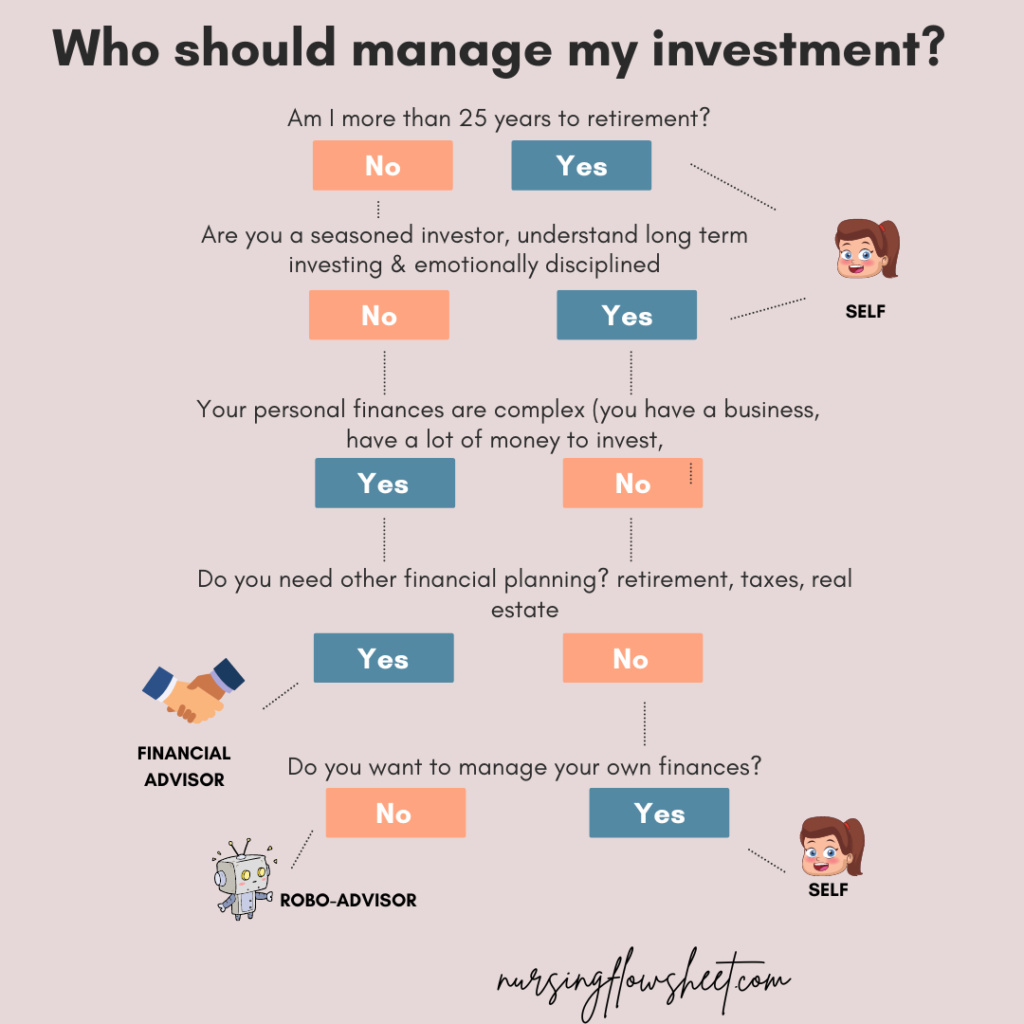

Decision Tree

Final Thoughts

Whatever method you choose, make sure that you are educated about the pros and cons of each method. There’s nothing wrong with managing your own investments and take reasonable risks as long as you know what you are doing. Self directed investing saves you the most money from fees.

If you are okay paying somebody to manage your investments, then you may want to get a robo-advisor or financial advisor to help.

Which is your method of investing? Comment down below!