As caregivers dedicated to the well-being of others, nurses often find themselves immersed in the world of healing, compassion, and patient advocacy. However, amidst the demands of a noble profession, it’s crucial for nurses to turn their attention towards securing their own future through thoughtful estate planning. In this blog post, we’ll explore the vital components of estate planning and discuss actionable steps that nurses can take to protect their financial legacy.

Understanding Estate Planning:

Estate planning is not just a concern for the wealthy or elderly; it’s a crucial aspect of financial literacy that everyone, including nurses, should prioritize. Simply put, estate planning involves making decisions about how you want your assets and affairs managed in the event of your incapacity or passing. By taking proactive steps now, nurses can ensure that their loved ones are well taken care of and their hard-earned assets are distributed according to their wishes.

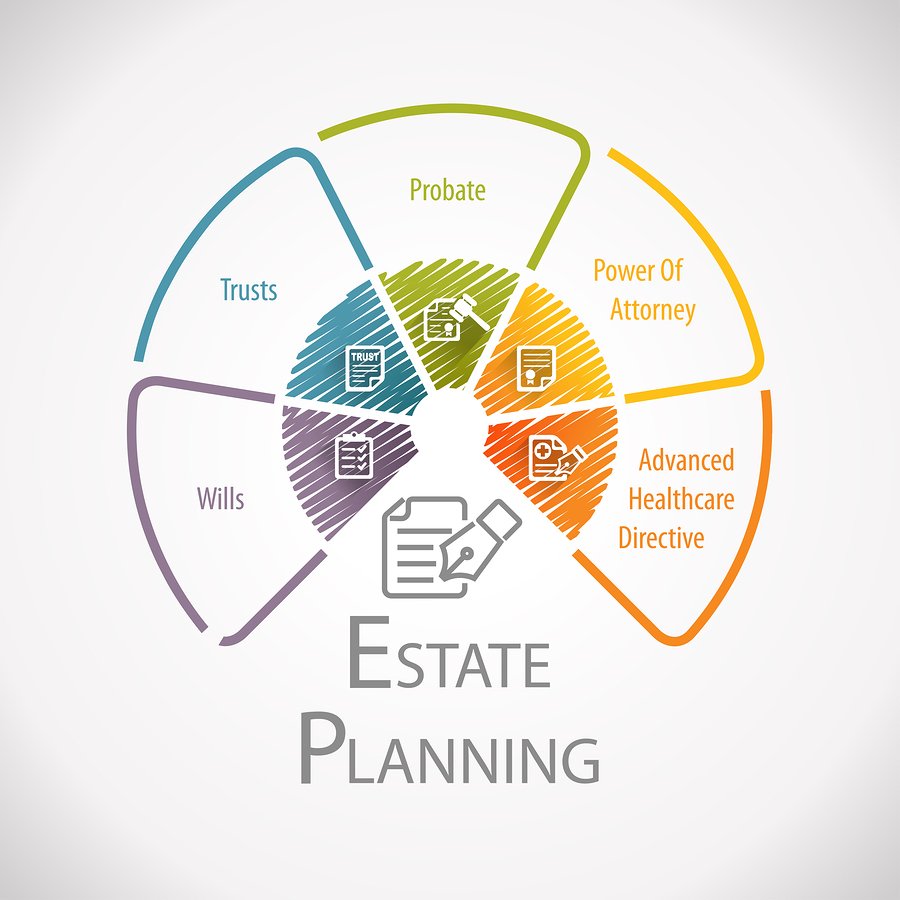

Components of Estate Planning:

- Will and Testament: Drafting a will is a fundamental step in estate planning. It allows you to specify how you want your assets distributed after your death and nominate a guardian for any minor children. Without a will, the state may decide how your estate is distributed, which may not align with your intentions.

- Power of Attorney: Designating a power of attorney allows you to appoint someone to make financial or medical decisions on your behalf if you become unable to do so. This is particularly important for healthcare professionals like nurses, who understand the significance of having a trusted advocate in times of medical crisis.

- Healthcare Directive: A healthcare directive, or living will, outlines your preferences for medical treatment in case you cannot communicate your wishes. As healthcare professionals, nurses can appreciate the importance of having a clear plan for their own medical care.

- Beneficiary Designations: Review and update beneficiary designations on life insurance policies, retirement accounts, and other assets. Keeping these designations current ensures that your assets go to the intended recipients.

- Trusts: Establishing a trust can provide additional control over the distribution of assets, potentially minimizing the impact of estate taxes and ensuring a smoother transfer of wealth.

Actionable Steps for Nurses:

- Start Early: Estate planning is not a one-time event; it’s an ongoing process. Start early, review your plan regularly, and make adjustments as needed, especially after major life events like marriage, divorce, or the birth of a child.

- Seek Professional Guidance: Consult with an estate planning attorney to ensure that your plan aligns with your unique circumstances and local laws. Their expertise can help you navigate complex issues and optimize your strategy.

- Educate Loved Ones: Communicate your wishes to your family and loved ones. Discussing your estate plan openly can prevent misunderstandings and ensure that everyone is aware of your intentions.

- Review and Update Regularly: Life is dynamic, and so should be your estate plan. Regularly review and update your documents to reflect changes in your financial situation, family structure, and preferences.

Conclusion:

In the demanding world of nursing, it’s easy to overlook personal financial matters. However, estate planning is a crucial aspect of securing a nurse’s legacy and ensuring the well-being of their loved ones. By taking proactive steps and staying informed, nurses can empower themselves to navigate the future with confidence, allowing them to continue their noble work with the knowledge that their financial affairs are in order.