There has been a lot of talk about a possible recession lately and this week, we will find out at the end of the month if we are in a recession or not. Recession is a word that scares a lot of people. Many of us have never been through a recession, but we remember how scary it was for our parents. I remember my mom having to declare bankruptcy and putting our house in foreclosure in the 2008 recession.

Recession happens and will continue to happen as long as we live. Preparing for a recession and surviving one can help minimize financial fallout.

Preparing for a recession is a lot like preparing for natural disasters. Having a go-to plan will keep you and your family safe in case the worst happens.

First of all, what is a Recession?

In simple terms, a recession means that the economy shrinks. People lose their jobs, consumers spend less, and economic growth slows down.

If you’re looking for a more technical recession definition, the National Bureau of Economic Research (NBER) describes it as : two consecutive quarters of negative real (inflation-adjusted) GDP.

Recessions are problematic for everyday people like you and me because finding a job can be harder, banks make it harder to borrow money, investments losing value and prices of consumer goods going up due to rising inflation.

A recession is not as severe as a depression or as harmful as stagflation, which is marked by a period of stagnant economic growth, steadily rising prices and high unemployment. But it’s not something that we don’t look forward to either.

How to Survive a Recession

The most important thing to keep in mind about recessions is that they’re unpredictable. There’s no telling exactly when we’ll have one or how long it will last. The more prepared you are, the easier you will get through it. Here are some ways on how you can survive a recession

1. Make a budget

If you’re not already living on a budget, then making one is the first step in preparing for a recession. One of my favorite finance trackers is EMPOWER (Personal Capital)

A budget is simply a plan for how you’ll spend your money each month. If you are like me, I am not a big budgeting person but knowing how much money comes in and out is helpful.

You add up your income, then subtract your expenses to see how much you have left (or how much you may be overspending.)

READ: BUDGETING FOR BEGINNERS

READ: WHAT IF BUDGETING IS NOT FOR YOU?

2. Evaluate your spending

Once you’ve made your budget, the next step for how to prepare for a recession is simple: eliminate unnecessary spending.

Some of the best ways to cut down on expenses are: negotiating bank fees, cancel subscriptions, reduce APRS on high interest credit cards etc.

3. Use cashback and coupon apps to save

Aside from cutting out unnecessary expenses, finding ways to save when you spend can help you to prepare for a recession.

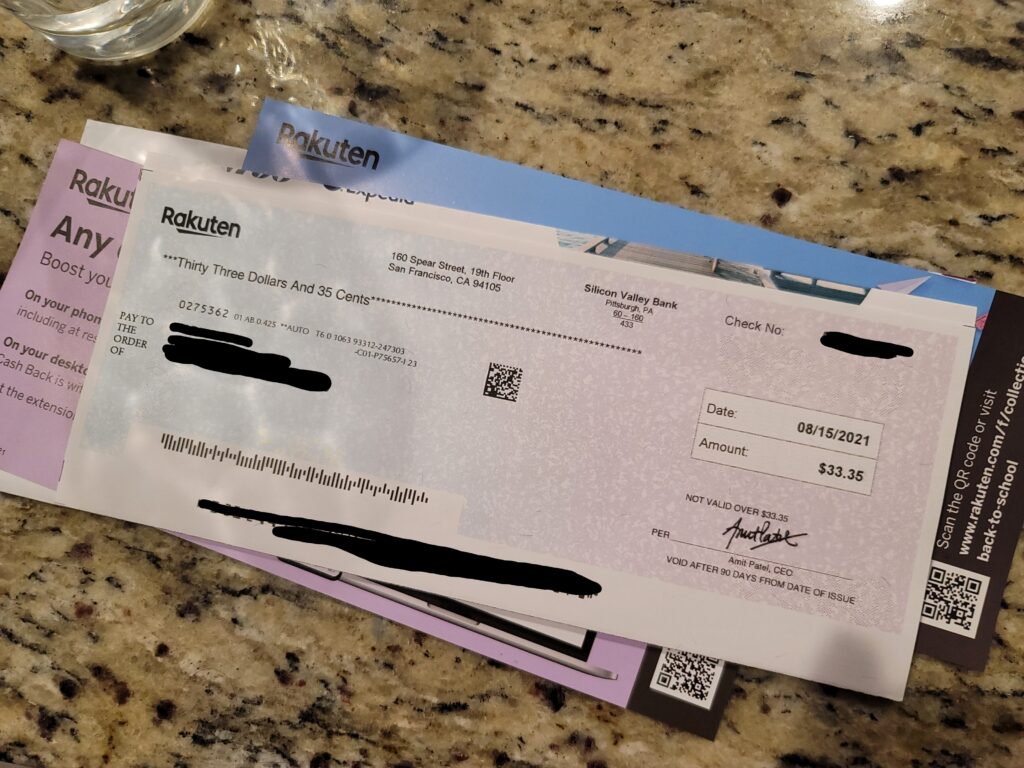

I started using RAKUTEN to earn cashback whenever I shop online.

Cashback apps pay you back money when you shop at partner merchants. Coupon apps can take money off your purchases at the checkout. You can use one or both to save money on things you buy every day, including groceries, household items and clothing.

Most cashback extensions are all free to sign up for and use and you can try one or all of them to save money and get cashback.

4. Build your emergency fund

I can not stress this enough but having an emergency fund will give you peace of mind in this time of uncertainty. Rule of thumb is to set aside 3-6 months worth of expenses for your emergency fund.

The best place for your emergency fund usually means:

- A liquid account you can get to quickly if you need to

- Ideally, a high-yield savings account that earns a great interest rate

- A bank or financial institution that’s FDIC-insured

Online banks can deliver all three. I personally have my emergency funds in Ally Bank and Capital One.

READ: WHY YOU NEED AN EMERGENCY FUND

5. Pay down debt

The total U.S. consumer debt is sitting at $13.51 trillion. The average household carries $8,282 in credit card debt.

It’s not news by now that millions of Americans are facing debilitating debt, but there is a way out. There are ways to pay off debt but being aggressive and planning how to pay it off is what works.

READ: HOW TO PAY OFF YOUR DEBT FASTER

6. Review your portfolio

You hear what they say that “wealth is built during recessions”. This is the time to invest. It could be scary investing your money right now, but this is the time when stocks are on sale. Diversifying by investing in index funds or dollar cost averaging will pay off 10-20 years from now.

READ: What to Invest in if you have $1000

If you have not started investing, you can learn how to invest in low-cost index funds or dividend stocks. You can also sign up for my free investing class HERE.

7. Reevaluate your financial goals

Setting financial goals can help you to get ahead. And for a lot of people, how to prepare a recession comes down to how you prioritize your money. Having goals and prioritizing them is very important. .

When you’re looking at your financial goals against the backdrop of a potential recession, make sure they’re realistic. And be prepared to have a backup plan in case your money situation changes and you need to adjust your goal focus.

8. Make more money

One of the smartest money moves for how to prepare for a recession is finding ways to grow your income. Having more money means having the means to increase your emergency fund and also having more money to invest or pay for your expenses. Some ways to make money is:

- Ask for a promotion or raise at your current job

- Move to another company

- Get a part-time job

- Start side hustles

READ: SIDE HUSTLES FOR NURSES

In Conclusion,

Recessions can be scary but knowing how to prepare for a recession is something you’ll be glad about if the economy does slow down. Recessions are a part of a healthy economy and will happen more than once in your lifetime. Preparing will give you peace of mind and also help you manage your finances better.