For most mothers, pregnancy is a dream come true. However, preparing for a baby is demanding and stressful task.

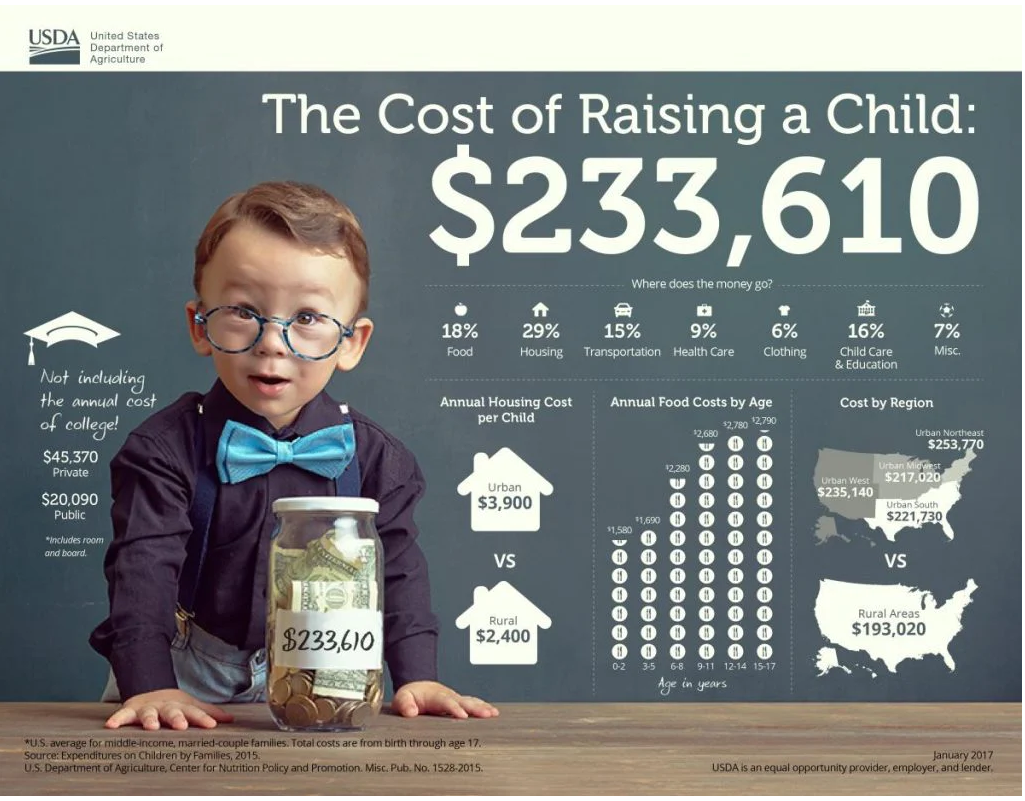

There were around 23.5 million employed women with children under the age of 18 and nearly two-thirds worked full-time. According to Mint.com, it costs around $1500/month or $18,000/year to raise a kid in the USA.

From USDA.gov, Middle-income, married-couple parents of a child born in 2015 may expect to spend $233,610 ($284,570 if projected inflation costs are factored in*) for food, shelter, and other necessities to raise a child through age 17. This does not include the cost of a college education.

For working moms like myself, the cost of having a child is definitely something that should be planned for.

There are so many things you could do, but these are the necessary things to do before maternity leave to help you financially:

1. First, save some $$$

This goes without saying. I didn’t know that I was going to be pregnant this year, but my husband and I have planned on having another baby after Eliana. As soon as we found out that we were pregnant last year, we set aside some money for things like:

- surprise baby necessities

- diapers, feeding (formula or breastfeeding supplies)

- bills that may incur during hospital stay (although we know we are privileged and lucky to have good health insurance)

Having a baby fund gave us a peace of mind even though we are going to be partially covered by paid leave when the baby comes out.

2. Plan when you go on leave & seek out any incentives and policies with HR

Every mother is entitled to specific maternity leave rights. These rights vary depending on the company’s maternity leave policies and the country’s laws on parental leave.

The good news is that some states provide paid family leave and fund pregnant mothers through short-term disability leave programs.

Here in California, mothers are entitled to 4 weeks of pregnancy leave & additional 6 or 8 weeks of leave (depending if you had a normal or C-section) after you deliver your baby. Your OB provider might also be able to provide you with disability leave before the 4 weeks of pregnancy. I went on my leave at 35 weeks due to sciatica back pain.

If you work for an employer, inquiring with HR regarding benefits will help not miss out on some incentives from going on maternity leave.

I also opened a Flexible Spending Account (FSA) last year to help with clinic co-pays, medical supplies for baby and myself, even breastfeeding supplies that might incur during this pregnancy.

3. Enroll in a short-term disability insurance policy

If you have a planned pregnancy, most policies require you to start prior to being pregnant. I made the mistake of enrolling late for my first pregnancy so I didn’t qualify to get the benefits from it.

I did not get any policy this 2nd pregnancy because our pregnancy was unplanned. However, having a short term disability will benefit workers because it covers 6 weeks of pay for normal birth up to 8 weeks for C-section.

4. Start a baby registry

There are lot of free items you can get by creating a baby registry. Amazon and Babylist also gives you a 15% off discount code when you create one at their website.

Here are some of the websites that gives free items:

- Amazon

- Walmart

- Target

- Babylist

here are the items that I received from the free registry bags. It’s good if you want to sample items before buying it them full-size.

5. Budget and Limit splurging

One of the things I cut out from my spending is buying luxury bags. We also decided to do more of our meals at home instead of doing take-outs. Due to the rising costs of grocery items and food, we found that it was cheaper for 2 adults to get a subscription for meal delivery. For this week, we are trying Every Plate.

This way, you will be reducing your expenses and at the same time enjoy doing the things that you love. I’ve also used 2nd hand items from family and if there’s a necessary item to purchase for baby, I buy it from the FB marketplace.

6. Take care of yourself- Health is Wealth!

It’s very important to remember that taking care of yourself as a mom is also vital to preparing for a new baby. If you can and need some “me time”, Indulge and pamper yourself.

7. Think Long Term

You need to maintain these healthy saving habits even after maternity leave. Remember that having children is expensive and saving for your future childcare expenses, medical costs and college accounts is also important.

You should also take advantage of the tax credits so that you can reduce your taxable income and save more money.

Conclusion,

Maternity leave will come and go before you know it. It’s time best spent bonding with your newborn and being a mother. There will be plenty of things that will come up as you adjust to your new role including: planning for home arrangements/childcare, adding your child to your insurance policy, finding a pediatrician etc.

But this list can at least set you up for a stress-less maternity leave when it comes to money.