I became a nurse at 21 years old. At that time, I was just happy I was making more than my previous job which is a sales associate at Forever 21. Growing up, money was never a part of conversation in our household. I didn’t really have anybody to talk about money with.

So, I never had money goals except to just SAVE money.

WHAT ARE MONEY GOALS?

Money goals are those things that you want to accomplish in your finances. They’re financial goals! Setting financial goals is important because they serve as a guide on how you manage your money.

It literally can be anything–from paying off student loans, to increasing net worth.

Money goals are no different than any other goals.. You should be in constant pursuit of achieving a goal.

You’ll quickly realize that money actually impacts other areas of your life and, ultimately, other goals that you may want to accomplish. Money is a tool. While it may not buy happiness, it can create opportunities and freedom so you can enjoy life a little better.

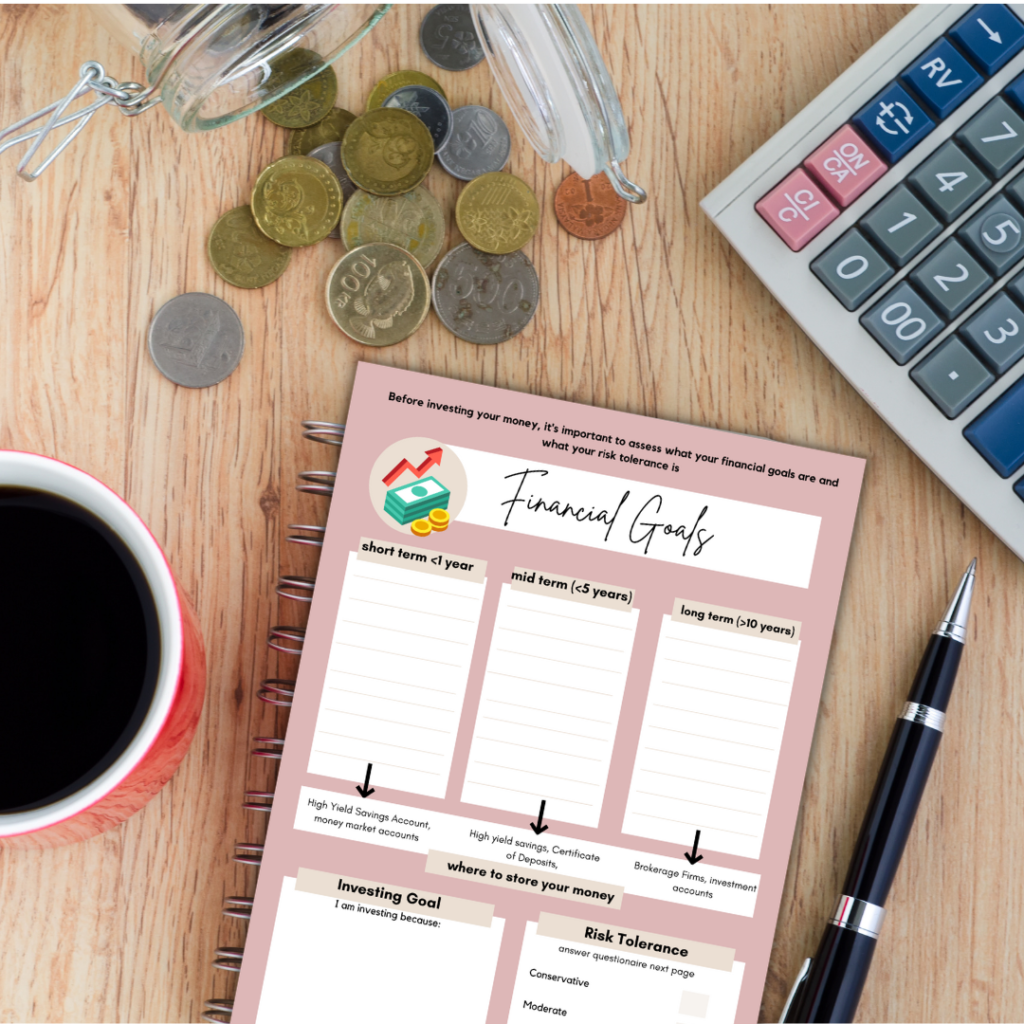

Financial goals are typically categorized in three different ways. You have short-term, mid-term, and long term financial goals.

Short term financial goals are things that you want to accomplish within 12 months. Consider these to be things that are easily attainable, like getting on a budget. Mid-term goals are things that you want to accomplish in 1-5 years. Lastly, long term goals are those financial goals that you want to achieve within more than 10 years.

MONEY GOALS IN YOUR 20s

1. Educate yourself about Personal Finance

Even though money play such a huge role in adult life, there is no classes about money in high school or college. Parents also don’t talk to their kids about money. Growing up, I never knew how much my parents made.

It wasn’t until in my late 20s that I learned about personal finance through MY OWN research and initiative. I bought courses. I watched YouTube videos. I read books. Being self-taught about money made me inspired to teach this knowledge to other people. That is why I created this blog.

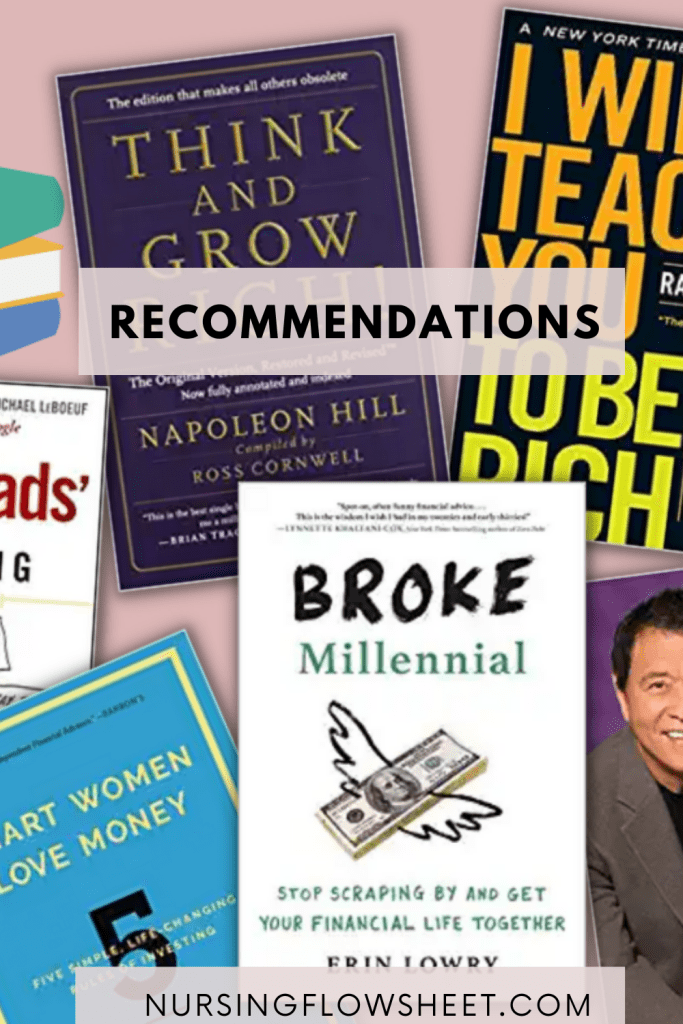

Here are some of the books I recommend reading:

1. Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not! -BY ROBERT KIYOSAKI

2. The Bogleheads’ Guide to Investing BY TAYLOR LARIMORE, MEL LINDAUER, AND MICHAEL LEBOEUF

3.Broke Millennial: Stop Scraping By and Get Your Financial Life TogetherBY ERIN LOWRY

4. Think and Grow RichBY NAPOLEON HILL

5. I Will Teach You To Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That WorksBY RAMIT SETHI

6. “Smart Women Love Money” BY ALICE FINN

Read this post about Personal Finance Books worth Reading

2. Spend less

There are two easy ways you can start building wealth in your 20s: spend less and earn more. Spending less is something you can do instantly to make an impact on your financial situation. It might seem obvious that you need to spend less if you want to save more, but what does that really look like?

It could be as simple as making your coffee at home. Or looking through your subscription lists like Netflix, Hulu etc and canceling one or two subscriptions.

Commit to spending less money and look for areas in your budget to cut back. Here are some easy ways to spend less:

- Try a no-spend weekend -You simply avoid spending any money for one weekend. You can get creative and find fun ways to entertain your family that require no money

2. Work on an Emergency Fund

Emergency Fund is very important. This is money that you can turn to when something unexpected comes up like a car repair or a modest medical bill. If you don’t have an emergency fund, start building it now. Put money into this dedicated HIGH YIELD savings account each time you get paid. Even if it’s only $50 per check, that’s still better than having nothing.

Ideally, you want to cover at least 3 months of living expenses. Life is unpredictable so having that security net in place can make a huge difference if you suffer a loss of income.

Read here why it’s important to start an emergency fund

3. Eliminate high interest credit card debt

How’s your credit score looking? If it’s less than stellar, set a goal to bump it up this year! Good credit is essential to your overall financial health, especially if you’re planning on making big purchases in the future. To qualify for a mortgage, get lower rates on car loans, and even take out personal loans, you need to show lenders that you’re responsible.

One of the ways to improve your credit score is to pay off your balances each month. I recommend paying off credit card bills with >10% interest. Pay it off slowly if you’re not able to pay it all off all at once.

Request a free copy of your credit report from one of the 3 major reporting agencies. Review the info and make sure everything is correct. If you find an error or spot an issue, take care of it as soon as possible.

4. Start a Retirement Account

Time is really your best friend when it comes to investing. The earlier you start, the better.

I didn’t care about retirement in my 20s because well, I told myself “I am too young to think about right now”. I was wrong. Compounding Interest is magic and should be used to your advantage. Your money will grow faster if you invest it earlier.

Starting early with retirement pays off big time down the road.

So after you’ve started that emergency fund and after you’ve paid off that high-interest credit card debt, start a retirement account.

If you have a job, you’re probably offered a 401K or 403B plan, make sure you sign up. If you don’t know what to fund your account, Go with index funds. It’s best for beginners and for long term investments.

If your job doesn’t offer a 401(k) or if you’re self-employed, open up a Roth IRA account. You can use an online broker service like Vanguard or Fidelity. Fund it with index funds.

Aim to contribute at a minimum 5% of your gross income to retirement. As you start to pay down debt and increase your emergency fund, bump up your savings rate.

Unsure about how to invest with index funds?

I wrote a short, easy to read E-Book on how you can invest in index funds for only $17

For more information about ROTH IRA account, read this article: 5 BENEFITS OF ROTH IRA ACCOUNT

5. Plan on paying off your Student Loans

The college debt many young people is definitely a baggage that keeps them from pursuing large financial goals like buying a home, or investing more. To give yourself some more financial flexibility to have a baby or start a business, make a plan to pay off your college debt as quickly as possible.

If you have any private variable loans, pay those off first. Try to also refinance those private loans.

For your federally-backed student loans, you have repayment plans to choose from. If you work in healthcare or public service, there are a lot of repayment options for you too.

If you’re not in a position to be super aggressive with your loan repayment because you’re just not making enough money right now, at least aim to put 10% of your gross income towards student loan debt. As you make more money, increase the amount of money you use to pay down your debt.

HOW TO ACHIEVE YOUR MONEY GOALS

After you’ve developed your goals, it’s time to do the work to achieve them. This is where the rubber meets the road and where many people fail. Here are the steps that you need to take to accomplish your financial goals.

Write them down – Studies show that goals that are written down are visualized are far more likely to be accomplished than those that are not. Keep them at the forefront of your mind so that you are constantly reminded to work toward them.

There is a financial goal worksheet that I made for FREE!

Break them down into daily, weekly, or monthly actions – Sometimes goals can seem overwhelming and unattainable. Try to break them down so it will be less overwhelming

Track your progress – Some goals take longer than others, so it’s important to see your progress in order to stay motivated.

Get accountability – Having someone support you and hold you accountable for your goals is probably the best thing that you can have.

FINAL THOUGHTS ON SETTING MONEY GOALS

Money drives almost all facets of life. So, getting control of your finances early in your 20s is one of the best things that you can do for yourself.