Inflation is at it’s all time high now. According to US Labor and Statistics, The annual inflation rate in the US accelerated to 8.5% in March of 2022, the highest since December of 1981 from 7.9% in February and compared with market forecasts of 8.4%.

When the Federal reserve said that inflation was “transitory”, we know by now that it’s wrong. The prices of commodities and continuing to go up while the value of the dollar we are earning keeps doing down.

So what can you do to beat inflation?

Here are some steps in beating the rising inflation rates

Invest smartly in your employer-sponsored retirement plan — and a brokerage account

Investing is a key to beating inflation. It’s the only way your money can keep up with the rising costs of commodities; Investing shouldn’t be complicated. If you are employed and contributing to your 401k or 403b, then congratulations, you are already investing! You can also open a ROTH IRA or an individual brokerage account

READ: How to get started with Investing

When investing, ensure that you have diversified portfolio. Remember to not put all your eggs in one basket. This means one that’s built from varied assets like stock funds and bond funds so that your exposure to any one type of asset is limited in the event of a downturn.

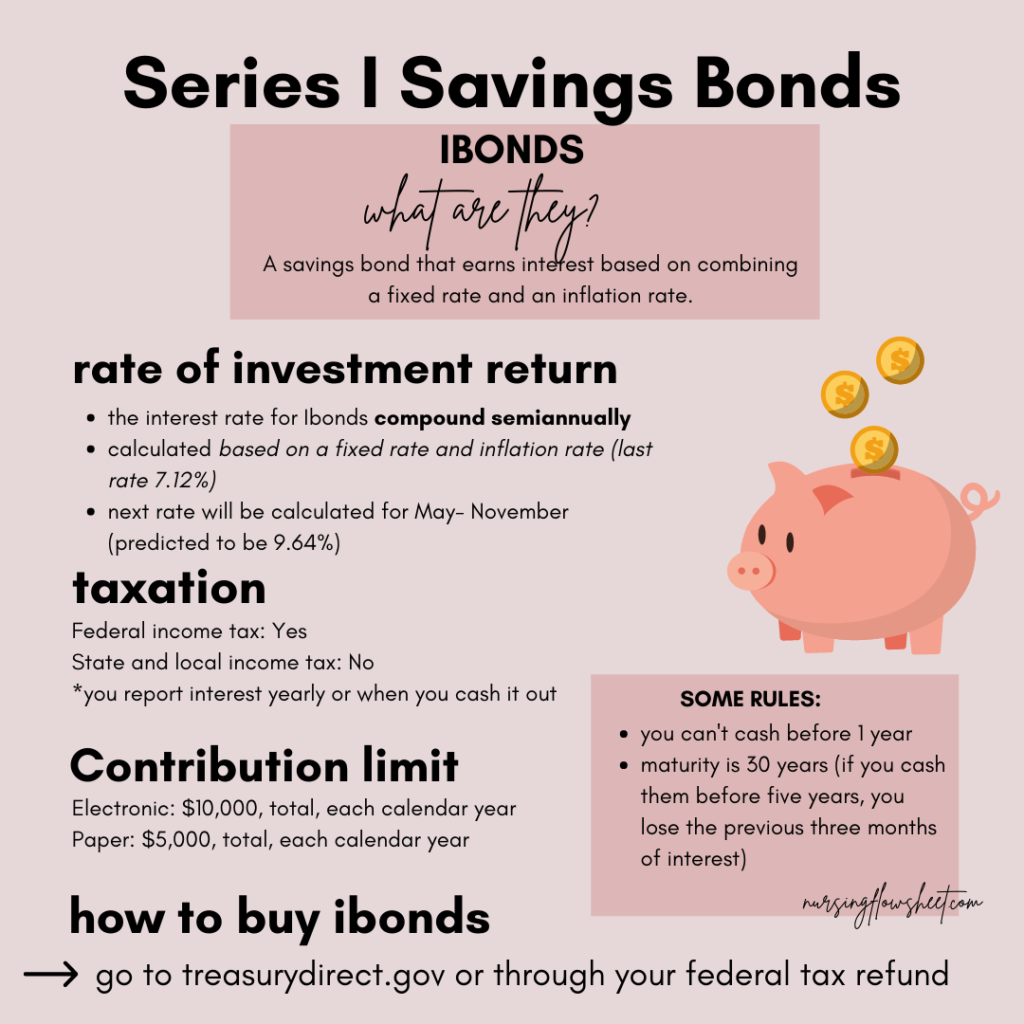

Consider investing on TIPS or IBONDS

Treasury Inflation-Protected Securities (TIPS) and I Series Saving Bonds (Ibonds) are government bonds that help protect you from inflation.

Bonds are loans given by investors to the government that accrues interest over time based on a rate.

Read: Difference of TIPS and IBONDS

Don’t keep an excess of cash on hand

Most of the older generation, my parents in particular loves to have liquid cash on hand at all times, which is great for emergencies but other than that, the cash you stash under your mattress will lose it’s value every day that you keep it in there. Your money can earn higher interest in the stock market that it would in a commercial savings account or in your wallet.

That said, don’t neglect your savings

Having cash that is easily accessible for emergencies or opportunities is also essential. Calculate 3-6 months of expenses and put that money in a high yield savings account. READ: Why you need an emergency fund

And you may also want to look at putting money in certificate of deposit (CD), but don’t chase yield by investing in a maturity that exceeds how long you can really live without the money.

If you are employed, this is the perfect time to ask for a raise

A study by Payscale found that only 37% of respondents had ever asked their current boss for a raise. Believe me that no matter how awkward this conversation may be, it is a part of having a job. Asking for a raise shows that you value yourself and the work that you contribute to your company.

Yesterday, I just received my yearly raise of 3%. While it is not a lot of combat inflation, it’s something. I am also a part of the hospital union who is proposing a raise for the healthcare workers at work.

Take a look at your expenses and how you can save

When inflation is high like it is, you often get hit with higher prices everywhere from the grocery store to the gas pump. So keep tabs on your budget and follow a spending plan to keep track of your funds every month. If you’re spending money in places that are enjoyable but maybe not essential, taking a break or pausing this type of expense can lead to savings in unexpected places.

Don’t panic

Yes, inflation is high, but if you’re investing, cutting costs where you can, and avoiding (if possible) highly inflated items, you’re a step ahead of many others.