A $1.7 trillion spending bill passed last week that included a a provision that lets savers roll money from 529 savings plan to ROTH IRAs free of income tax or tax penalties.

Section 126 of the bill amends the Internal Revenue Code so that beneficiaries of 529 plans can roll over funds from their 529 accounts to Roth IRAs tax and penalty free, effective for distributions after December 31, 2023.

The change could boost participation in these plans — only 19% of parents take advantage of them — now that these penalties can be avoided.

529 savings are great investment accounts for your kids that could be used for education purposes.

READ: 6 INVESTMENT ACCOUNTS FOR YOUR CHILDREN

What are 529 plans?

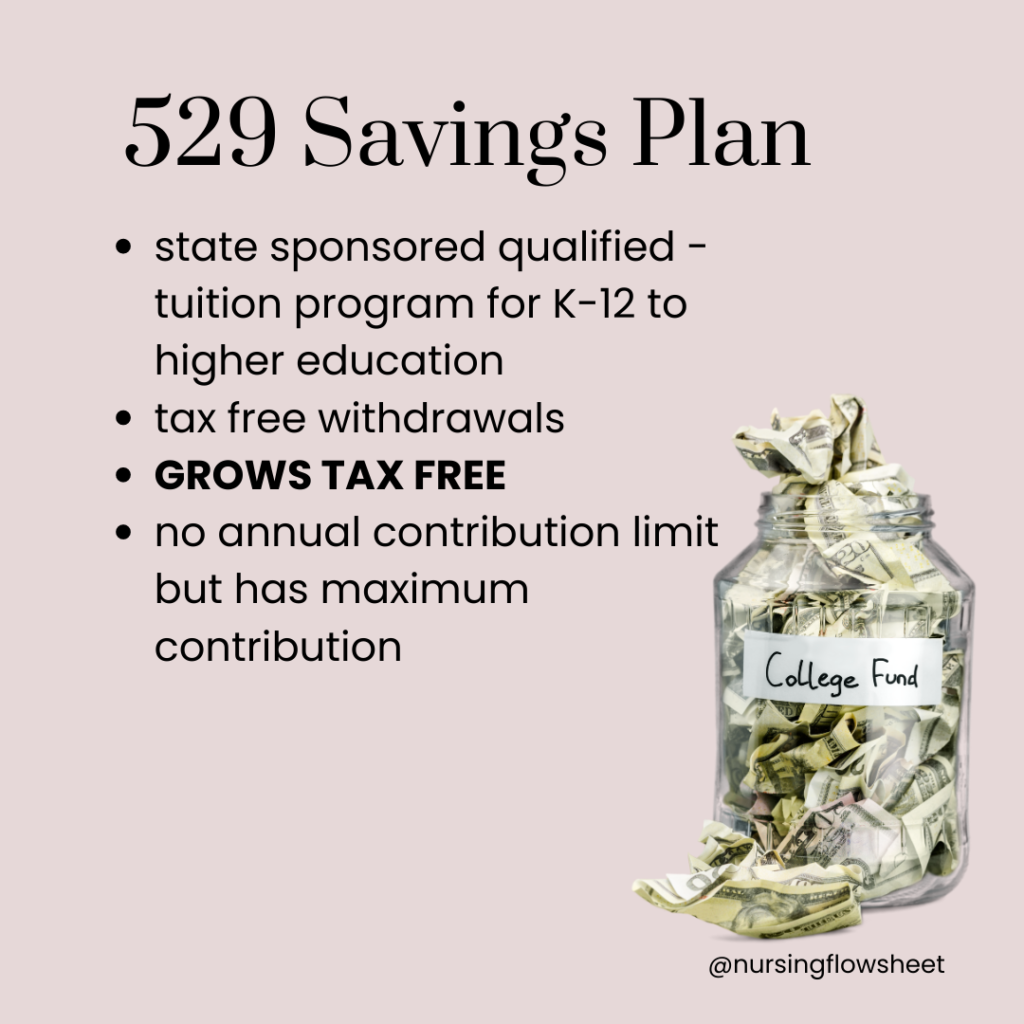

529 plans are state-sponsored qualified tuition programs that can be used for education expenses like K12 education, college tuition and apprenticeship programs.

The funds grow tax free. Although there’s no federal deduction for contributions, many states offer a full or partial tax deduction. There are no income limits, age limits, or annual contribution maximums for 529 plans.

I have one for my daughter and contributing $200/month to it since she was born.

529 savings plan are accounts opened by guardians (parents) for their child (beneficiary).

529 plans have two options: a prepaid plan or a savings plan. Colleges and states can offer prepaid plan which allows you to prepay tuition at today’s rate at eligible private or public colleges. In state college tuition has risen 93% since 2003, so this allows you to hedge against the rising cost of education.

Most families choose the savings plan, only offered by states. Even though it’s called a “savings plan”, the money in it is actually invested. Similar to 401(k) retirement accounts, you can invest in mutual funds or ETFs. There are also “target date” plans known as age-based plans.

Some of the drawbacks of 429 plans are:

- Limited investment options

- Limits financial aid in college- your child may not qualify for FAFSA

- Strict rules or restrictions like:

- You can only change plan investments twice per year.

- Although you can transfer between different states’ 529 plans, you can only do it once in any 12-month period.

- Many states limit contributions on 529 plans after account balances reach a certain amount. For example, the maximum account balance in New York is $520,000.

New rollover option in 2024

There are some restrictions to the rollover option in the spending bill.

Only the beneficiaries can take advantage of the rollover option, not the account holder such as the parent or grandparent who set up the plan in the first place. The account must have been open for more than 15 years. And beneficiaries can rollover a maximum of $35,000 during their lifetime from any 529 account in their name to their Roth IRA — subject to Roth IRA annual contribution limits.

Even with these restrictions, it offers greater flexibility and peace of mind for parents should their children not go to college or money is left over in the accounts. The unused funds can also help their adult children meet other major financial milestones.

In my opinion, this bill is really great if you have “too much saved up for your child”. For example, you saved up $100,000 in the savings plan and only used $80,000 for your child’s college expenses. You can take the rest of the money $20,000 and roll it over to your child’s ROTH IRA which sets them up and gives them a head start for retirement.

What are you thoughts?? Comment down below!