With rapid increasing college tuition and costs of every day necessities, it’s important now more than ever to save for your child’s future.

Raising children costs a lot of money and could be very stressful for some parents, yet it’s one of the most important jobs. Investing in your child’s future is a great gift to give.

Last month, I give birth to our 2nd child & I realize that I need to think about their future now.

Invest Early

Time with your child is precious. From their first steps to their first words to their first days in preschool then kindergarten until they go to college. Time is so valuable to spend with your kids. Just as it’s important to spend time with them, it’s also an important factor with investing.

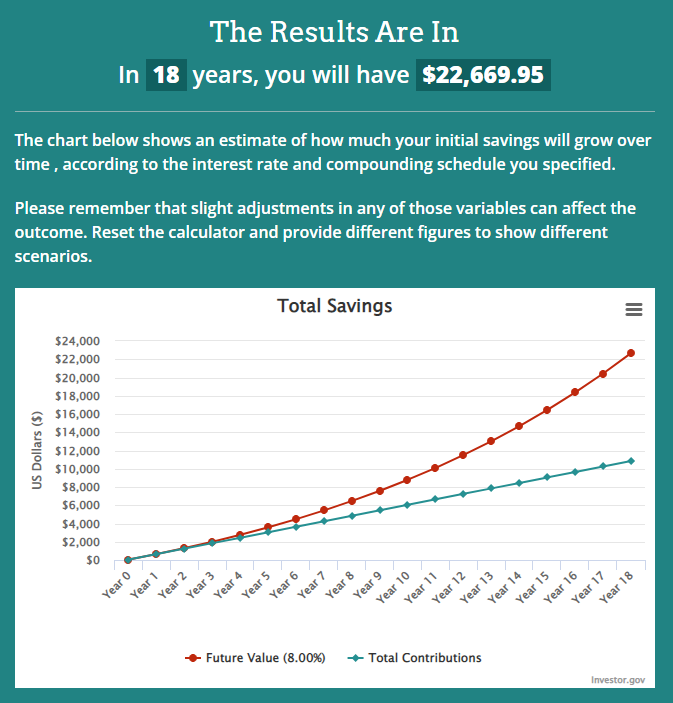

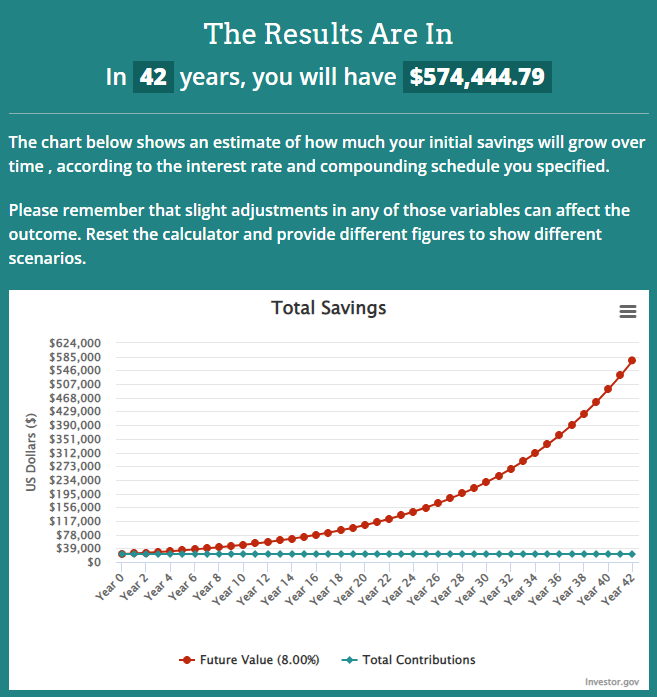

Investing early can make a big difference in their portfolios when they get older due to compounding interest.

Imagine investing more!

Here are 6 ways to invest for your children

1. Roth IRAs

The most important thing to know about a Roth for your child is that THEY must have earned income during that tax year. You can contribute as much as they made, up to the annual Roth IRA limit (currently $5,500). Income can include a formal job as well as things like babysitting. It will be up to you to document that they had income.

The great thing about ROTH IRAs is that your child’s investment can grow tax-free and can be taken out tax-free at a certain age.

2. Coverdell ESAs(Education Savings Account)

Previously called the Education IRA, Coverdell accounts offer tax-free investment growth and tax-free withdrawal when used for qualified education expenses. Annual contributions are capped at $2,000 and your adjusted gross income must be less than $220,000. ESAs offer more investment flexibility than a 529 plan.

3. 529 Plan

Since education is important for our family and something I would like to provide for my children, I opened a 529 savings plan for both my children. 529 plans vary greatly from state to state in how they are set up. You can pick any states 529 plan regardless of where you live.

The savings from this account is used for educational expenses including education expenses like K12 education, college tuition and apprenticeship programs.

You can pick a 529 plan as a retirement tool as well for your kids.

For my kids, I opened an account for them at California Scholarshare. I contribute around $150-$300 per month for my daughter’s account and $50-$200 for my son. (the reason why I contribute more for my first born is if she decides not got to college or use the funds for educational expense, you can transfer it to family member), you can also open it through Fidelity (zero minimum amount to invest).

Here is how you open and fund a 529 in easy steps.

4. UGMA/UTMA

The Uniform Gift to Minors Act and Uniform Transfer to Minors Act (UGMA/UTMA) are essentially a way to pass on accumulated wealth to the next generation. Like Roths and Coverdells these can be set up at most brokerages like Fidelity or vanguard. Unlike the 529 plans, you will have complete control over how your money is invested.

READ: What is an UGMA/UTMA Account

5. Savings Account

Don’t forget about the good old simple savings account. If you are going to open a savings account, make sure you open it in a HYSA (High Yield Savings Account) so you don’t miss out on the interests. The drawback with savings account is that you may be tempted to use the money inside it because the it’s highly accessible and liquid compared to other accounts.

6. Individual Brokerage

Lastly, I am a big proponent of investing FOR YOURSELF FIRST before investing for your children. You can invest for your children by opening your own individual brokerage and gifting them money in the future. I open another individual brokerage account that is “marked for Eliana & Mateo”.

This is helpful to shelter assets from financial aid as well as not giving a 18 year old complete access to the funds that you have been investing so hard in.

These assets can easily be gifted to your kid at a later time tax free (using the lifetime gift tax exemption act).

READ: STRATEGIES TO GIFT CHILDREN OR GRANDCHILDREN MONEY

Summary

These are all good options and what’s right for your particular family will vary. Make sure that you look at the pros and cons of each account. The most important thing is getting started early and also giving your children the gift of financial education. The power of compounding interest needs time.

Have you started saving for your child? What has been your favorite plan if you have already started the savings process