Taxes is one of the biggest expenses for nurses, and If you are not knowledgeable on how you can lower down your taxable income and take advantage of tax deductions and credits — MOST most your nursing salary will all go to Uncle Sam (government) – we don’t want that!

Understanding Tax Deductions

Before delving into specific deductions, it’s essential to grasp the concept of tax deductions. A tax deduction is an expense that can be subtracted from a taxpayer’s gross income, reducing the taxable income and, consequently, the amount of taxes owed. Deductions serve as incentives for specific behaviors or expenses, and understanding them is crucial for maximizing savings. This is different from a tax credit which is the amount of money that taxpayers can subtract directly from the taxes they owe.

Before claiming any tax deductions, nurses should ensure they meet the eligibility criteria set by tax authorities. Generally, eligible expenses must be:

- Necessary and ordinary: The expense should be common and accepted in the nursing profession.

- Directly related to work: The expense should have a clear connection to the nurse’s job duties.

- Not reimbursed by the employer: Only expenses that haven’t been reimbursed by the employer are eligible for deductions.

To understand tax deductions in simple terms, let’s say you made $60,000 a year living in the region of California, USA, you will be taxed $13,653. That means that your net pay will be $46,347 per year, or $3,862 per month. Your average tax rate is 22.8% and your marginal tax rate is 39.6%. If you spent $100 on scrubs that year, you could deduct that from your taxable income.

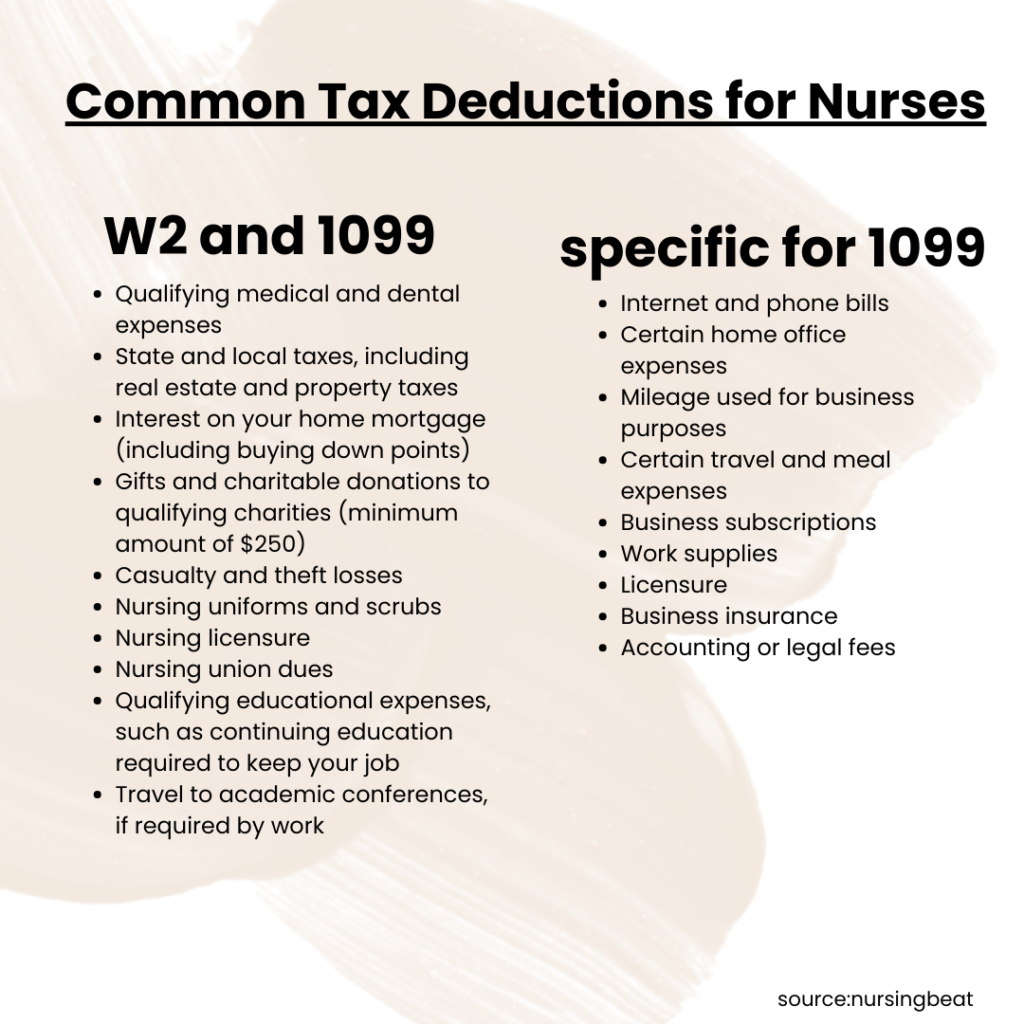

Another thing to keep in mind is that there are two types of employment, and your tax implications will be different depending on how you are paid by your company or hospital.

Payroll or W2 employees: Payroll employees are paid a regular paycheck by their employer and receive a W-2 at the end of the calendar year to file taxes.

Contractors: Contractors pick up gig work and don’t have the guarantee of a regular wage and receive a 1099 form. If you pick up gig work as a W-2 employee, you would be responsible for both W-2 and 1099 forms and the taxes for each

As your income and tax bracket increase, these deductions save more money. But individually deducting your taxes (an itemized deduction) isn’t always the way to go. So let’s explore both options.

Standardized vs Itemized Deductions

Standardized Deductions

To provide relief to middle-class workers and protect all income from being subject to taxes, the IRS allows a standardized deduction option for all taxpayers. When adjusted for inflation, the 2023 standard deduction is as follows: $27,700 – Married Filing Jointly or Qualifying Surviving Spouse (increase of $1,800) $20,800 – Head of Household (increase of $1,400) $13,850 – Single or Married Filing Separately (increase of $900)* Data from IRS.gov

Itemized Deductions

You can reduce tax liability with itemized deductions if you have more deductions than the above standard amount. These are deductions for specific expenses.

This requires filling out Form 1040 or seeking assistance from an accountant.

Common Tax Deductions for Nurses

Lower Your Taxable Income by Retirement Account Contributions

Contributions to retirement accounts are an excellent way for nurses to save on taxes while securing their financial future. Contributions to employer-sponsored retirement plans, such as 401(k) or 403(b), are typically tax-deductible. Nurses should take advantage of these opportunities to reduce their taxable income while building a nest egg for retirement.

READ ABOUT RETIREMENT ACCOUNTS

Tax Credits

In addition to deductions, nurses should explore available tax credits that can directly reduce their tax liability. Some notable tax credits for healthcare professionals include:

- Child and Dependent Care Credit: Nurses with dependents may be eligible for this credit, which helps cover the costs of childcare while they are at work.

- Earned Income Tax Credit (EITC): The EITC is designed to assist low to moderate-income individuals and families. Nurses meeting the income criteria should explore this credit as a means of reducing their tax burden.

- Lifetime Learning Credit: For nurses pursuing higher education to enhance their skills, the Lifetime Learning Credit can be a valuable tax-saving tool.

Consult Tax Professionals

Navigating the complexities of tax laws and regulations can be challenging. To ensure nurses maximize their tax savings and take advantage of all available deductions, seeking advice from tax professionals is highly recommended. Certified public accountants (CPAs) or tax advisors specializing in healthcare professions can provide personalized guidance based on individual circumstances.

Last, be organized and document everything

Proper record-keeping is essential for claiming deductions accurately and avoiding potential issues during tax audits. Nurses should maintain organized records of receipts, invoices, and any relevant documentation supporting their deduction claims. This includes records for education expenses, travel-related expenses, and any other deductible items.

In Conclusion,

Nurses can significantly enhance their financial well-being by understanding and leveraging available tax deductions. From education expenses to home office deductions, nurses have various opportunities to reduce their taxable income and maximize savings. By staying informed about eligibility criteria, keeping meticulous records, and seeking professional advice when needed, nurses can navigate the tax landscape with confidence. As the healthcare industry continues to evolve, nurses can proactively manage their finances and secure a more prosperous future.