Calculating your net worth is an important part of managing your finances. It’s another metric that helps you track your financial situation and help you set yourself for success. Most people don’t like calculating their net worth because they think it’s complicated but it’s actually simple!

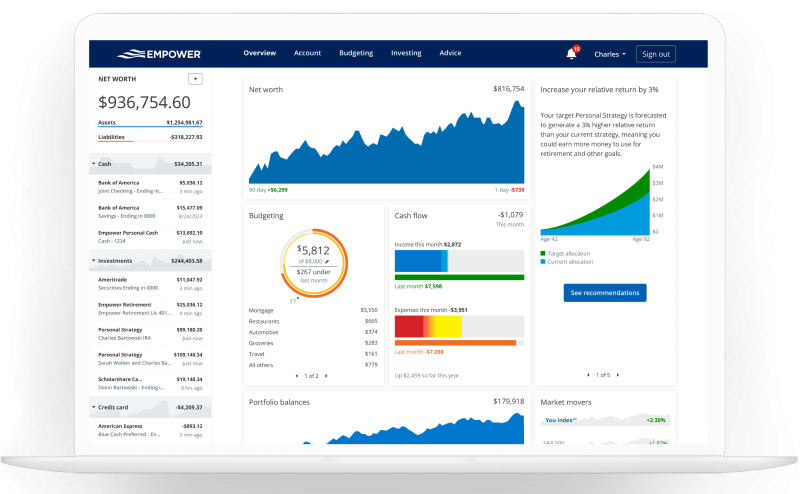

If you are not yet tracking your finances, here is a free app to do that: EMPOWER

Let’s talk about why and how to calculate your net worth!

WHAT IS NET WORTH?

Net Worth = Assets – Liabilities

What does this formula mean?

Net worth is calculating how much wealth an individual has.

The formula takes everything you have of monetary value (assets) minus everything you owe or all the debt you have (liabilities).

Your assets includes cash, retirement savings, stocks, bonds, vehicles, houses, and anything else you own that you could sell and make money from.

Your liabilities include student loans, credit card debt, car loans, mortgages, and money you owe to family or friends.

Your net worth basically tells you how much money you would have left if you sold everything you owned and paid it on your debts.

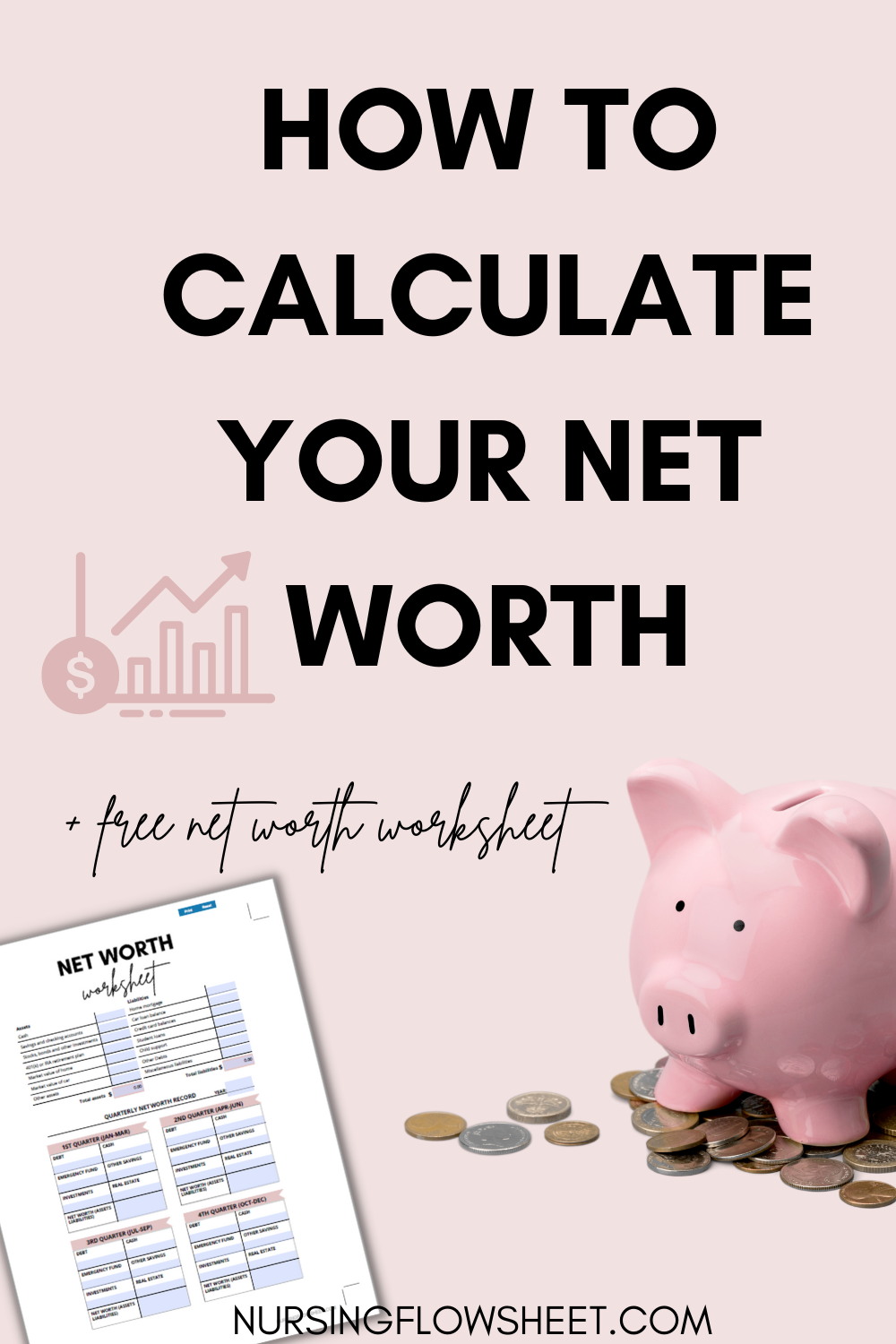

Use this worksheet to find out where your finances really stand!

HOW TO CALCULATE YOUR NET WORTH

To calculate your net worth, you just need to follow the formula above!

First, list out all your assets and their values.

Here’s a guideline of what values to use for each type of asset:

- Cash/Savings Accounts – the balances of your checking and savings accounts, money market accounts, and any cash you have.

- Retirement and Investment Accounts – the amount of money you would get if you cashed out your retirement account today.

- Vehicles – the best and easiest way to get the current value of vehicles is using Kelley Blue Book.

- Personal Property – estimate the value of any personal property you want to include in your net worth (things like jewelry, furniture, electronics, etc.)

- Real estate – you want to use the current market value of any property you own, or what you would be able to sell it for today.

Once you have values for all of your assets, you want to total them all up.

Next, list out all your liabilities and their values. This is a little easier — the value of your debts like credit card bill, student loans, mortgage amount

Now subtract your total liabilities number from your total assets number. You just calculated your net worth!

Total Assets – Total Liabilities = Net worth

Another way is using apps like mint.com to make it easier for you.

HOW TO INCREASE YOUR NET WORTH

There are several ways you can increase your net worth. If your net worth is negative, don’t panic. It’s normal. According to CNBC, Americans who are younger than 35 years old, median net worth is 13,900 and average net worth of $76,300.

The main ways to increase your net worth is to increase your income or assets or/and reduce your debt by paying off student loans or high interest credit card bills.

READ: How I increased my net worth to $300,000 in 3 years.

Tackling your credit card debt and student loans will increase your net worth.

If you are in the habit of spending more than you make (i.e. using a credit card), you will be consistently decreasing your net worth.

Get on a budget, cut your expenses, and start paying off your debt — this will put you on a good path to positive net worth.

WHY KNOWING YOUR NET WORTH IS IMPORTANT

Knowing your net worth gives you an overview of your financial situation. It gives you the “big picture” of your finances. Your net worth is affected by every single financial decision you make, so it’s a good benchmark to track your financial progress over time.

Knowing where your net worth stands can be very motivating to make changes to your financial habits. I know, it did for me.

Also, knowing your net worth lets you realize that it’s not about how much you make, but how much assets you keep.

A nurse who makes $190,000 a year living in San Francisco may not necessarily have a higher net worth than a nurse making $70,000 in Louisiana.

Figure out YOUR OWN financial goals and what works for you.

HOW TO TRACK YOUR NET WORTH

I recommend tracking your net worth on a monthly basis. You can use a spreadsheet, pen and paper, or one of the many financial apps including MINT or YNAB out there. Or, you could grab my net worth worksheet and print one out each month!

Calculate your net worth at the end of every month so you can compare it to the rest of the year. This will let you see trends in your net worth over time and give you an idea of what direction you’re going. You’ll be able to adjust your budget accordingly to make sure you are moving towards your financial goals!

When you track your net worth, you’ll be able to easily see the progress you are making.

Whether you are focusing on paying off debt, saving for an emergency fund, or investing to build wealth, you’ll see the increase in your net worth each month. This can help keep you motivated and on track!

Get started today by calculating your net worth with my FREE worksheet, and make the changes needed to push your net worth in the right direction!