When most people think about financial freedom, they picture aggressive saving, cutting every expense, and retiring at 40. That is what I used to think I need to do to “retire early”. However, there is another path, one that is realistic, especially for nurses in their 20s and 30s.

It’s called Coast FI, and it’s a game changer.

With Coast FI, you save and invest early—enough to let time and compound interest do the rest—so you can “coast” the rest of the way without needing to save more for retirement.

Here’s how I was able to do it and reach it in 2023 and how you can do it too:

1. Understand What Coast FI Is

Coast FI means reaching a point where your retirement savings can grow on their own (thanks to compound interest), and you no longer need to contribute more.

You’re not retired—but you’ve taken the pressure off.

If you hit Coast FI at 30, you can stop saving for retirement and just cover your living expenses moving forward.

That means:

- Taking lower-stress jobs

- Working part-time

- Exploring new careers or passions

- Saying yes to a slower, more spacious life

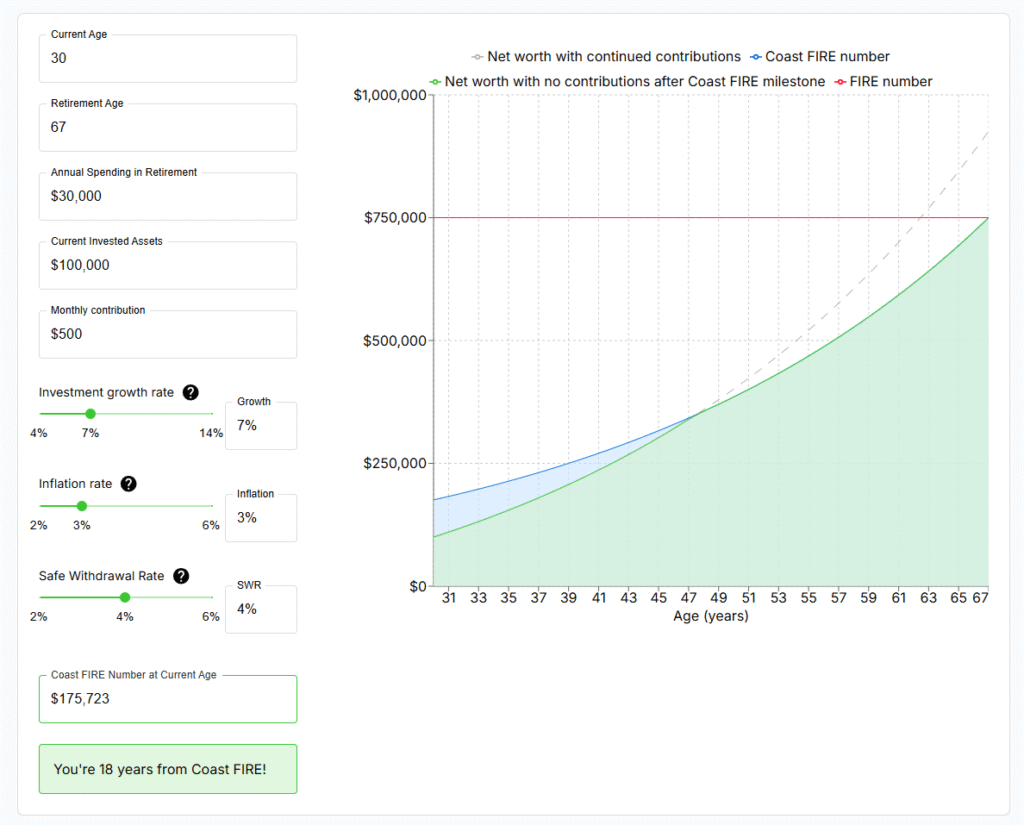

2. Know Your Coast FI Number

Your Coast FI number is how much you need invested today to let it grow to your retirement goal by traditional retirement age—without adding another dime.

Let’s say you want $1.5 million by 65.

If you’re 30, you might only need around $200k-$250k invested today (assuming 7% returns) to coast the rest of the way.

Use a Coast FI calculator or meet with a financial planner to find your exact number.

3. Start Investing Early and Automatically

The younger you are, the easier Coast FI is to hit—because time is your secret weapon. I started “late” when it comes to investing. I really wish I had started earlier in my nursing career. But as a nurse, you can take take advantage of:

- Employer-sponsored 401(k) or 403(b) accounts

- Roth IRAs for tax-free growth

- High-yield savings accounts for short-term goals

- Brokerage accounts to build additional wealth

Even $500/month invested in your 20s can snowball into hundreds of thousands later.

4. Don’t Just Save—Invest With Purpose

Many nurses are great at saving… but afraid to invest. No matter how intimidating investing is, this is something you can do. I host a class to teach more about stock market investing. Enroll HERE

If you want to reach Coast FI, investing is non-negotiable.

Focus on:

- Low-cost index funds (like VTSAX or S&P 500 ETFs)

- Tax-advantaged accounts

- Consistency over perfection

Set it. Automate it. Let it grow.

5. Design a Career You Actually Enjoy

Once you’ve hit Coast FI, you don’t need to chase the highest-paying job anymore.

That means you can:

- Leave toxic work environments

- Pursue school or passion projects

- Take a non-bedside role with better hours

- Travel more without financial guilt

You don’t have to hate your job to build wealth. Coast FI gives you the freedom to choose work you love.

Final Thoughts

You don’t need to wait until 65 to enjoy your life. You can in fact enjoy it now. Retirement is not something you have to wait for until you are in your 60’s. I am so glad I came across the FIRE movement because it had given me more options in my career and in my life.

If you’re a nurse in your 20s or 30s, Coast FI gives you the best of both worlds:

financial security later and flexibility now.

✨ Want to learn how to invest as a nurse?

👉 enroll in my class

[…] READ: Coast Fi For Nurses […]

[…] Retire Early) late in my career but now that I had been serious about my financial health, hit COAST FI & now working because i want to, I want more nurses to have the […]