A stock market crash or recession can have far-reaching impacts on all sectors of the economy, and healthcare is no exception. As a nurse, you may feel anxious about job security, financial stability, and the overall economic environment. However, nursing is a profession with unique strengths and opportunities, even in tough economic times.

This blog post will explore practical steps you can take during a recession or stock market downturn.

Understanding the Recession and It’s Impact in Your Job

First of all, What is a Recession?

A recession is a significant decline in economic activity that lasts for months or even years. Experts declare a recession when a nation’s economy experiences negative gross domestic product (GDP), rising levels of unemployment, falling retail sales, and contracting measures of income and manufacturing for an extended period of time

It’s also important to understand how a recession might affect the healthcare sector. Typically, healthcare is considered a recession-resistant field due to the consistent need for medical care. However, budget constraints, shifts in healthcare funding, and changes in patient behavior (such as postponing elective procedures) can still pose challenges.

What to do when the Stock Market Crash as a Nurse

Focus on What You Can Control

As retail investors, you can’t control the performance of the stock market. Stock prices are driven by a variety of factors, but ultimately the price at any given moment is due to the supply and demand at that point in time in the market.

However, there are things that we can be in control of, and that includes our spending habits and savings rate. As a nurse, you should be focusing on building your emergency fund, tracking where your money is going, cutting unnecessary expenses and focus on your long term goals.

One thing to point out is that investing in the stock market (even during the bad days), automating your investments aka dollar cost averaging and continuing to increase your savings rate is also something you can do.

Don’t Panic Sell

Be fearful when others are greedy, and greedy when others are fearful.-Warren Buffet

If you are one of those nurses who checks your 401(k) balance at every meal, today might be a good day to fast.

The news, the media makes money off “fear mongering” and getting clicks so you will often see headlines that invokes emotional responses from the viewers or readers. DO NOT LET this guide how you should be managing your money. Investing based on emotions is not a good strategy.

Instead, look at this downturns as opportunities to buy stocks at a cheaper/discounted price.

Think Long Term

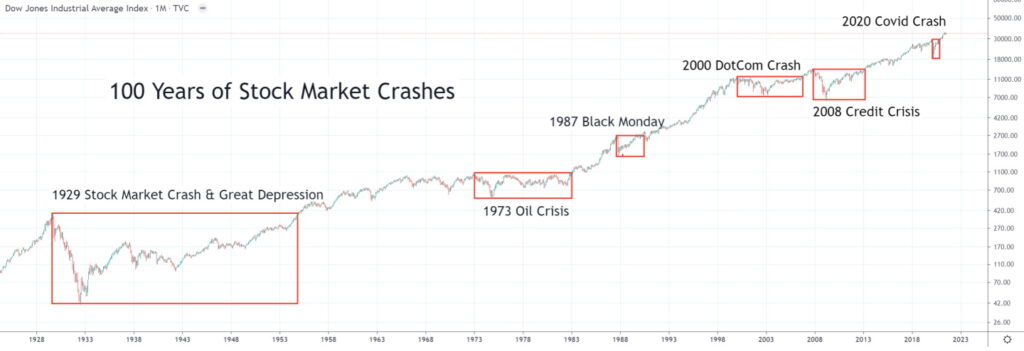

Market volatility is normal and a part of a healthy economy. Just about every year since 1980, the market has experienced a temporary decline of 5% or more. On average, a 5% decline in stock market prices has occurred 4.5 times a year over the same period (according to Covenant Wealth). If you think long term and not retiring tomorrow, this stock market crash should not worry you.

Be Proactive and Stay Positive in a Stock Market Crash

When the stock market was all red and everyone was panicking yesterday, I am working my full time job. If you have a full time job right now, you’re blessed. As you go to your shifts, keep in mind that investing in your skills will also make you valuable in your profession. Continue making yourself marketable because the best investment is in yourself.

Another thing to consider is thinking of investing in other assets other than the stock market assets. A common mistake made by many investors during bull markets is an oversized allocation to equities. It’s not uncommon to see investors with 100% in stocks. This approach is highly risky and inefficient. Adding non-correlated assets such as bonds (especially Treasurys), gold, commodities or real estate can lower risk without impacting returns too much. During a crash, some of these assets can soar in value, allowing investors to sell them at a profit. Investors can then use these proceeds to rebalance into their pummeled equity positions, thereby buying them at a low price. A crash is a good way to test whether or not your risk tolerance is sound.

Here is a cheat sheet of other investments to invest your money into:

Also remember that there has been multiple crashes in the stock market history, if you are not retiring tomorrow or at least in the next 5-10 years, you should not worry. Stay positive and focus on what you can control.

Conclusion

While a stock market crash or recession can create uncertainty, nurses are in a uniquely strong position to weather the storm. By maintaining and enhancing your skills, diversifying your expertise, networking, and practicing sound financial planning, you can protect and advance your nursing career. Additionally, exploring non-bedside roles, staying positive, and leveraging available resources can provide further stability and growth opportunities.

Nursing is a resilient and adaptable profession. By being proactive and prepared, you can navigate economic challenges and continue to make a meaningful impact on the lives of your patients. Remember, every challenge presents an opportunity for growth and learning. Stay strong, stay informed, and keep moving forward in your nursing career.