Marriage is often perceived through the lens of love, companionship, and emotional fulfillment, and while these aspects are crucial, another significant reality of a marriage is that it is a financial decision. Understanding this can help ensure a prosperous and stable future.

I have been married with my husband for over 5 years, and have been together for almost two decades.

Here are the reasons why Marriage is a Financial Decision:

1. Merging Financial Histories

When you get married, you’re not just combining lives; you’re merging financial histories. This includes credit scores, debts, assets, and financial habits. A partner with a poor credit history or significant debt can impact your financial stability and future borrowing power. Before tying the knot, it’s vital to have open discussions about financial backgrounds and to plan how you’ll manage combined finances.

2. Shared Financial Goals and Values

Alignment in financial goals and values is crucial. One partner might prioritize saving for retirement while the other values spending on experiences and travel. Discrepancies in financial priorities can lead to conflicts. Discussing and agreeing on financial goals and creating a joint budget can foster harmony and ensure both partners are working towards a shared vision of the future.

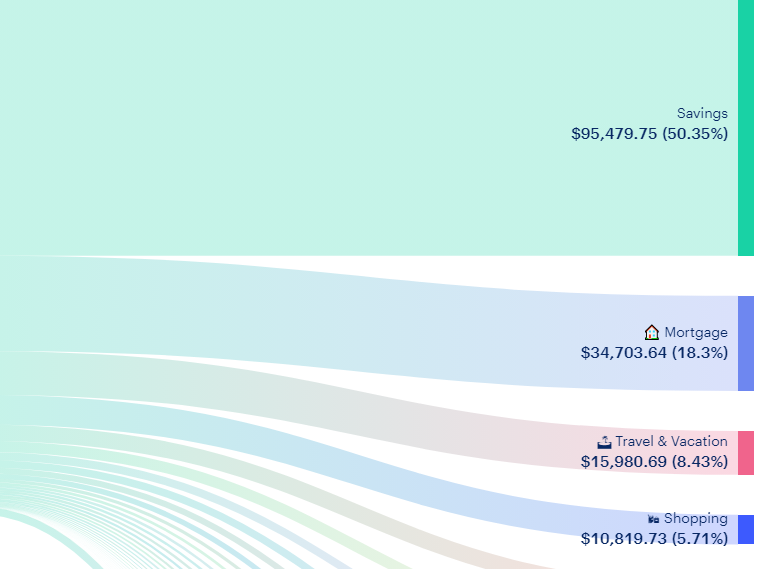

If you want something that can help you better track your finances as a couple. My husband and I love MONARCH MONEY. You can do a 30 day trial and a 50% off their annual subscription if you use our link!

I am looking at our finances this week and it’s nice to see that my husband and I have saved 50% of our income halfway through the year.

3. Impact on Career and Income

Marriage can significantly impact career choices and income. Decisions about relocating for a job, one partner staying home to raise children, or both working full-time need careful consideration. These decisions affect household income, savings potential, and career trajectories. Ensuring both partners are on the same page regarding career and income expectations is critical for financial planning.

4. Legal and Tax Implications

Marriage comes with legal and tax benefits and responsibilities. Married couples often enjoy tax breaks and can benefit from spousal contributions to retirement accounts. However, they are also jointly liable for debts incurred during the marriage. Understanding the legal and tax implications and planning accordingly can enhance financial benefits and minimize liabilities.

5. Emergency Preparedness

Life is unpredictable, and emergencies can arise at any time. Having a partner who is financially responsible and prepared for emergencies, such as medical crises or sudden job loss, is invaluable. Building an emergency fund together and having insurance policies in place can provide a safety net that ensures financial stability during tough times.

READ: Why You Need an Emergency Fund

6. Investment and Savings Strategies

Combining incomes can offer more opportunities for investment and savings. A financially savvy partner can contribute to better investment decisions, whether it’s in stocks, real estate, or retirement funds. Collaborating on investment strategies and regularly reviewing financial plans can significantly enhance wealth accumulation over time.

7. Retirement Planning

Planning for retirement is a long-term financial goal that requires careful consideration and collaboration. Both partners need to discuss their retirement visions, savings strategies, and timelines. Disparities in retirement planning can lead to insufficient funds and stress in later years. Aligning retirement plans ensures a comfortable and secure future together.

Conclusion: The Importance of Choosing Wisely

Choosing a life partner is one of the most significant decisions you’ll ever make, and considering the financial aspect is crucial. A partner who aligns with your financial values and goals can contribute to a prosperous and stress-free life. Open communication, transparency, and mutual respect in financial matters are the foundation of a successful marriage. By approaching marriage as a financial decision, you can build a solid financial future together, ensuring that love and money can coexist harmoniously.

Magnificent beat I would like to apprentice while you amend your site how can i subscribe for a blog web site The account helped me a acceptable deal I had been a little bit acquainted of this your broadcast offered bright clear idea