It’s the season for holidays, and it is time to be financially savvy and budget! One thing I love about the holidays is time with family, shopping, traveling, attending parties and of course gifting! I don’t know about you, but it’s during the holiday season that I really splurge on spending for people I care about.

Holiday Spending Statistics (Editor’s Choice) Americans spent $789.4 billion on winter holiday retail sales in 2020. The average projected spending for the 2020 winter shopping season is $997.79 per household

It is important to keep holiday spending in your financial plans as spending can get out of hand. You also would want to plan ahead so you don’t get overwhelmed with last-minute money stress and end up overspending.

Having a budget alone may not stop you from mixing up debt with all the holiday cheer. But having one will help you stick to your budget & make holidays enjoyable.

Here’s what I am doing to save during this holiday season:

1. Create a Holiday Budget

Write down your shopping list and ensure you include the cost of gifts, food, drinks, travel, decorations, greeting cards, postage stamps, charitable giving, etc. Calculate how much money you need to match your planned spending.

I made a holiday budget sheet that you can download also to help with your holiday spending.

In making a budget, here are some of the things you have to keep in mind: Is your budget achievable? Reasonable? Do you need to cut out some “fluff” to make your budget realistic?

My holiday budget for this year:

- Holiday Travel: $1000 (we go somewhere during December to spend time/ relax). This year we are planning to bring Eliana to the aquarium in Long Beach and spend the weekend there.

- Holiday Décor: I use up my old décor every year so I don’t really spend anything for décor

- Holiday Gifting: $1000 for immediate family members, $500 for friends and co-workers $100 to donate to the homeless shelter

2. Start Saving Early

Now that you have a budget, it is time to build up your holiday fund. The earlier you start, the better.

What I do is I max out my 401k retirement account earlier earlier so the last month of the year, the money I am supposed to put on my 401k, I use for holiday spending. ( However, I stopped doing this after realizing that I don’t get my matching contribution if I max out early) Read: 401k Retirement Accounts Mistakes You Should Avoid

For this, you have to be practical. If your holiday spending budget is $1,200 and you have 90 days or roughly 3 months to reach it, it means you need to save an average of $100 per week or $400 per month to reach your goal.

There are a lot of auto saving apps you can use to set money aside without overthinking it. These apps save/invest your spare change and can also help you reach specific savings goals.

3. Start Shopping Early

Do not wait until the last minute to start shopping for the best deals available and taking advantage of discounts. Major sales events to look out for include Black Friday and Cyber Monday.

I do most of my holiday shopping during Black Friday.

Before making purchases, do some comparison shopping online to confirm the best available price. Stick to your shopping list and tick off items once they are purchased.

If you find it difficult to stay disciplined with using a credit card, consider paying for all gift items with cash.

If you are planning to travel, book your flights and accommodations early. As the holidays draw closer, flight and hotel costs can increase rapidly.

You should also take advantage of free shipping. Some online retailers offer free shipping to entice shoppers during the holiday period.

4. Make Extra Money

In addition to savings, another way to reach your holiday spending goal without breaking the bank is to generate more income. You can start an additional side gigs like pet-sitting through Rover, tutor online, sell used items on Poshmark or Facebook marketplace, take paid surveys.

5. Save Money With DIY

If you’re crafty, you can save money during the holidays but creating gifts. Some of your friends and family will appreciate a well-thought-out homemade gift.

You can try out baked goods, handmade gift cards, soaps, jewelry, perfumes, candies, jams, to name a few. Save money by buying ingredients and/or arts and crafts in bulk.

My sister in law gave us personalized Family Frames for christmas last year, and it was one of the best gifts I received!

6. Maximize Your Holiday Shopping Rewards

If you are using a credit card for your holiday shopping, ensure it is the one that offers good rewards.

Rewards, either cash back or points, add up and can save you as much as 5% on your spending. In addition to credit card rewards, there are several other online loyalty programs/apps that pay you every time you shop.

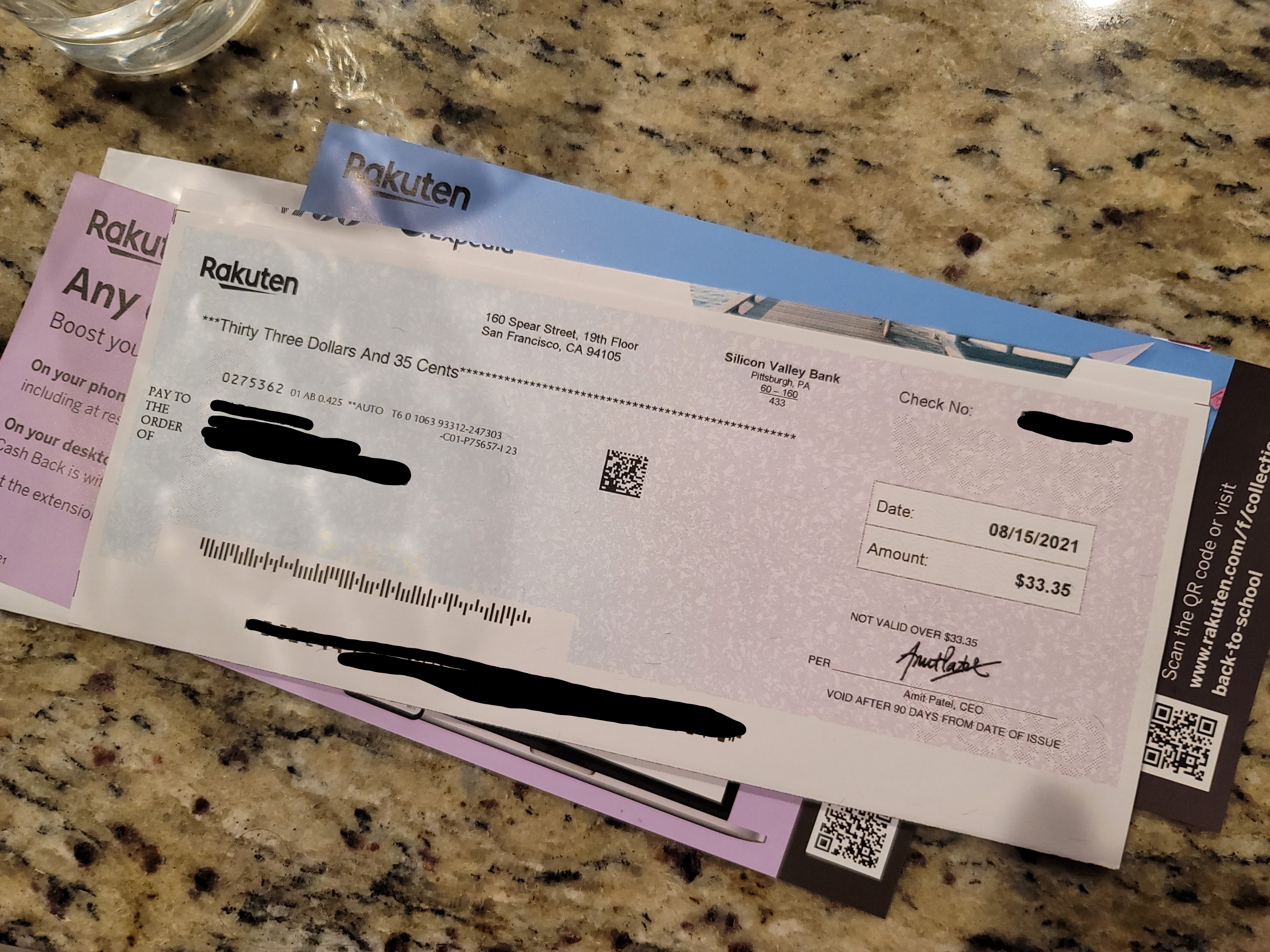

RAKUTEN is one of my favorite places to get a cashback. Here is the check I received from them just from spending online!

SIGN UP HERE TO RECEIVE $40 as sign-on bonus

7. Keep It Simple

The holidays should be all about catching up with friends and family, taking some time out to reflect on the year and your future, and putting a smile on the face of others.

Don’t let last-minute shopping, gift-giving, and the need to impress sabotage your peace of mind.

If you are unable to meet your holiday spending fund target, don’t fret. Sometimes, giving people your undivided attention and time is more than enough.

In the midst of it all the festivities, don’t forget to lend a hand to those in dire need, the hungry, homeless, and those in need of comfort

That’s what the holiday is all about!