When I graduated as a nurse practitioner, I was faced with a dilemma: Should I pay off my student loans first or should I start investing? It’s really an age old question but very common.

To answer this question, we’ll first have to analyze your student loan interest rate vs. the investing expected return.

Student Loan Interest Rates

First off, you have to know what your student loan interest rate is. Your student loan interest will depend on the type of loan: subsidized vs. unsubsidized, undergrad vs. graduate vs. parent, and possibly other factors.

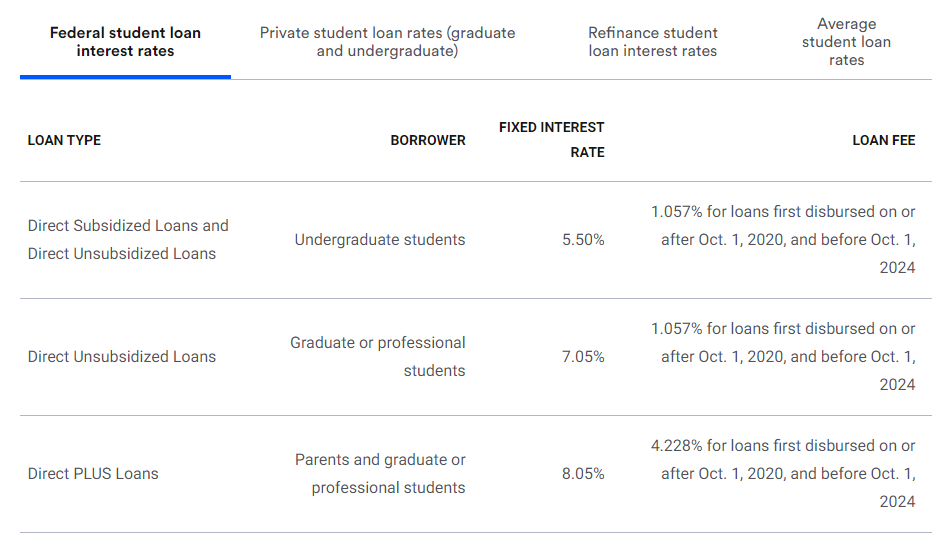

In just one example, here’s a table that provides interest rates for Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans according to the Studentaid.gov site

If you have something called a Perkins Loan, the interest rate is fixed at 5%, regardless of the first disbursement date.

You’ll have to pay interest on capitalization, in a similar way to how we collect compound interest on our investments. Basically you’ll be paying interest on top of your interest. Just like how you’ll gain interest on top of your interest when your investments are collecting compound interest. This is why I always say compound interest could work in your favor or against it.

For some types of loans, you’ll also have to pay a Loan Fee. This loan fee is in addition to your interest and loan principle payments.

Investing Expected Return

The second number your need to calculate is your expected return of your investments.

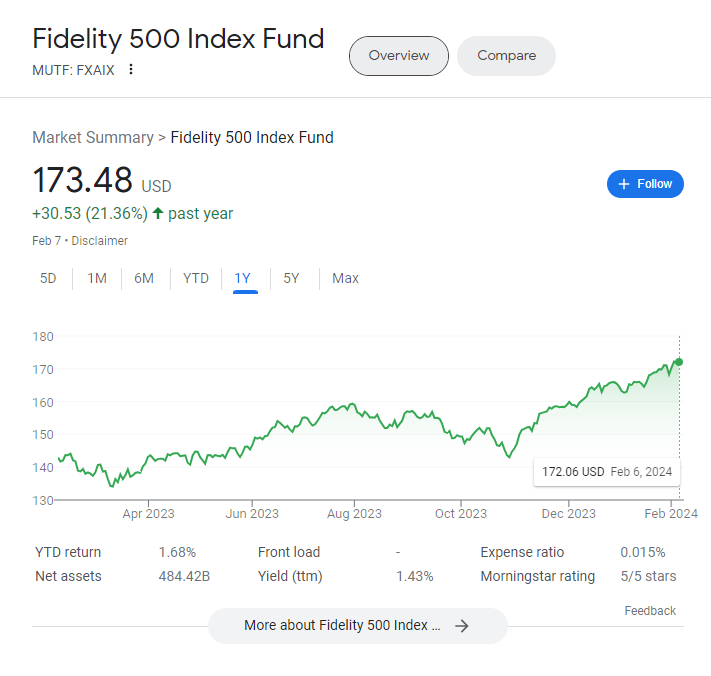

If you plan to invest in an S&P 500 index fund (which is a good choice) your expected rate of return is NOT fixed. It will fluctuate, but if history serves as a good predictor. I talked about the 10 year return of this index in many of my posts.

Read: 5 index funds that will make you rich

Looking at this index fund from Fidelity that tracks s&p 500 (FXAIX) – in 2024 (the past year, it has been up 21%)

LEARN HOW TO INVEST IN INDEX FUNDS WITH THIS EBOOK

Comparing Effective Loan Interest Rate vs. Expected Investing Return

It’s best to look at your actual loan paperwork and statement to determine your actual student loan interest.

Let’s say for example that your loan interest rate is 4%.

On the conservative side, we’ve seen that the S&P 500 index has returned 9.19% over 15 years.

If you want to compare a longer time frame, it has returned an average of 10-11% annually from 1926-2018. Source: Investopedia

Since the market yield is expected to be much higher than the loan interest rate (10% > 4%), you should invest your money. If you’re gaining 10% at a cost of 4%, you are essentially receiving a 6% net return over the long run.

Your decision should change if your loan interest is significantly higher. For example, if the loan interest rate were 8% or higher, I would definitely recommend paying off the loan before thinking about investing. A 8% guaranteed return (zero volatility), in my opinion, is better than taking a market return of 10% with substantially more risk (in the short term).

If you do decide to invest, you should still pay off the minimum balance on your student loan as to avoid delinquency and/or default.

There might be instances when paying off your student loan sooner works

Psychological Freedom

Some people would advise you to just pay off your student loan as quickly as you can to get the burden of the loan off your mind. This was my reason why I decided to aggressively pay off my student loans WHILE investing.

While I think that it gave me the peace of mind. I realized, why pay off your student loans at a 4% rate, when your money will grow much quicker in the stock market? It maybe psychologically freeing but probably not the best economical choice.

Big Purchase

Are you looking to purchase a car or a home soon? What does your credit score look like? Before you’re able to make such a purchase, it is common practice for your lender to look up your credit score. Your credit score is a number that they use to determine your credit-worthiness. The higher your credit score, the more trustworthy the lender will see you as.

Having a gigantic student loan to your name may negatively impact your credit score. A lender might be reluctant to provide you a mortgage if you still owe $150,000 in student loans! Just think about it. If the student loan is hurting your score, and you want to make a big purchase soon, it might make sense to pay off your student loan, rather than invest.

Circumstances when you should invest

There may be other favorable circumstances in which investing rather than paying off your student loan is a no-brainer.

Corona Virus

I hate to call Covid a favorable circumstance, but it might be when it comes to your loans.

According to studentaid.gov: “To provide relief to student loan borrowers during the COVID-19 emergency, interest is being temporarily set at 0% on federal student loans.”

0% interest!

Read more on: Student Loan Forbearance, Forgiveness due to Covid 19

The government is providing you money without charging you interest. This means FREE Money! I mean, you’ll have to pay back the principal, but without interest temporarily. It makes a ton of sense to invest your money in stocks paying 10% a year, rather than paying off a loan charging 0% interest.

401K Match

Does your employer offer to match your 401k contributions? 401k match is a common benefit that many employers offer today. The most common match is 50 cents on the dollar up to 6% of the employee’s pay. Source: Investopedia

Let’s say that your salary is $80,000. That means that if you contribute anything up to 6% of your salary, which in this case is $4800, your employer will match half of your contributions, which in this case is $2400. This is $2400 in free money that your employer will help contribute to your 401k plan.

This free money should further entice you to invest, at least up to the percentage amount matched by your employer.

In Conclusion,

Should you pay off student loans or invest? The best answer to this is to determine WHERE YOUR MONEY WILL BE BEST SPENT.

There are a lot of factors to consider whether you should pay off your student loans first or invest. It will also depend on your own financial situation, income status and goals.

You might want to pay your student loans off sooner to give you substantial peace of mind and psychological freedom or if you want to manage your credit score better for a big purchase like home. There are also favorable circumstances like student loan forbearance or Covid relief programs where you should just invest your money first.

Let me know your thoughts below! Would you pay off student loans or invest? Are there any other factors that would affect your decision?