Debt can feel overwhelming, but it doesn’t have to be. With the right strategy and a bit of determination, you can take control of your finances. Nurses work tirelessly caring for others, but financial stress can take a toll on well-being. Today, we’re diving into a simple, seven-step plan to help you pay off your debt efficiently and effectively.

The Debt Landscape for Nurses

Let’s start with some eye-opening statistics. The average American carries around $38,000 in personal debt, with credit card holders having an average revolving balance of over $6,700. For nurses, student loans add an additional layer of financial pressure:

- Associate Degree in Nursing (ADN): Average debt is $19,928

- Bachelor of Science in Nursing (BSN): Average debt around $23,711

- Master of Science in Nursing (MSN): Average debt approximately $47,321

With nearly 70% of students graduating with student loan debt, nurses must take proactive steps to manage their financial future. The good news? There’s a clear path to paying off debt while still living a fulfilling life.

Step 1: Understand Your Debt

The first step in your journey is to grasp exactly what you owe:

- Make a list of all your debts, including the total balance and interest rates.

- Don’t shy away from this task—it’s vital to know your starting point.

- Understanding your debt is empowering. It’s the first step towards financial freedom!

Step 2: Track Your Spending

Once you know what you owe, it’s time to track your spending for 30 days:

- Record every dollar that comes in and goes out.

- Many people are surprised by how quickly small purchases add up.

- Consider using tools like MONARCH MONEY – great for couples , Empower (Personal Capital) and You Need A Budget (YNAB)– if you like zero-based budgeting

Step 3: Create a Spending List

Now that you’ve tracked your spending, it’s time to categorize your expenses:

- Need to Spend List: Housing, food, insurance, transportation, and loan payments.

- Want to Spend List: Dining out, subscriptions, shopping, entertainment.

This will help you determine areas where you can cut back and free up money for debt repayment.

Step 4: Cut Unnecessary Expenses

Here comes the hard part: trimming your “Want to Spend” list.

- Identify areas where you can cut back—be ruthless.

- Consider cheaper alternatives for your favorite activities, like bringing lunch to work instead of eating out.

- Redirect that extra money toward paying off your debt.

Step 5: Consider Debt Consolidation

If you’re dealing with multiple debts, consolidation might be a viable option:

- Combine several debts into one loan, often at a lower interest rate.

- Transfer high-interest credit card debt to a 0% APR balance transfer card.

- Be mindful of any fees and ensure this strategy fits your repayment goals.

Step 6: Choose a Debt Repayment Strategy

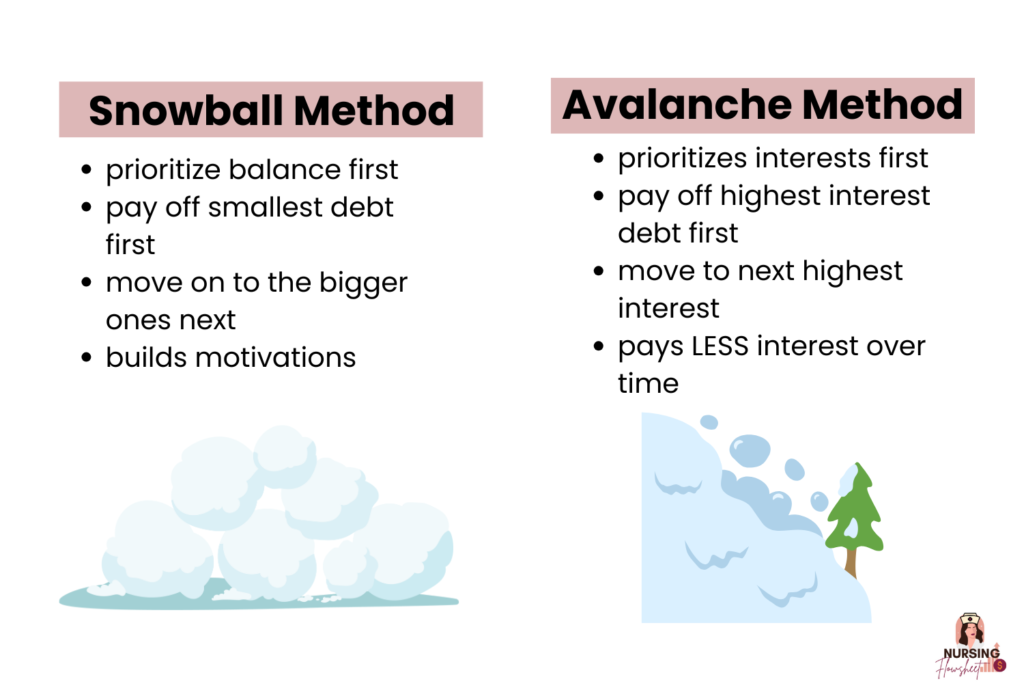

Now that you’ve streamlined your finances, it’s time to tackle your debts. You have two main strategies to consider:

- Snowball Method: Pay off the smallest debts first to gain momentum and motivation.

- Avalanche Method: Focus on paying off the debts with the highest interest rates first to save money over time.

Both methods have their merits—choose the one that keeps you motivated.

Step 7: Increase Your Income

If you’ve cut back on expenses and still struggle to pay off debt, consider increasing your income:

- Work overtime or pick up extra shifts.

- Explore side hustles, such as travel nursing, per diem shifts, or freelancing.

- Consider working in a high-paying specialty, such as critical care or anesthesia nursing.

Bonus Tip: Explore Loan Forgiveness Programs

Many nurses qualify for loan forgiveness programs, which can help eliminate debt faster:

- Public Service Loan Forgiveness (PSLF): If you work for a qualifying employer and make 120 qualifying payments, your remaining federal student loan debt may be forgiven.

- Nurse Corps Loan Repayment Program: This program pays off up to 85% of unpaid nursing education debt for nurses who work in underserved communities.

Consistency is Key

Remember, tackling debt is not a sprint—it’s a marathon.

- Stay consistent with your efforts, and make debt repayment a priority.

- Celebrate small victories along the way to stay motivated.

By following these steps, you can take control of your financial future. It may seem daunting, but every step you take brings you closer to financial freedom. Download Financially Free Nurse Checklist

Thank you for reading! If you found this guide helpful, share it with a fellow nurse. Together, we can conquer debt and build a brighter financial future!