Your career is demanding, and achieving financial freedom may feel like a distant goal, but open enrollment is one opportunity that can bring you a step closer. Open enrollment is a crucial period when you can make changes to your health benefits, insurance, and retirement plans. These choices not only impact your current finances but also play a key role in your long-term financial health. Here’s what you need to know to make the most of open enrollment and maximize your financial potential.

1. Understanding Open Enrollment

Open enrollment is the annual window (usually lasting a few weeks) when you can adjust your employee benefits, such as health insurance, retirement contributions, and other perks like flexible spending accounts (FSAs) and health savings accounts (HSAs). It’s your opportunity to make strategic decisions that can save you money, enhance your benefits, and support your journey to financial independence.

2. Health Insurance: Maximize Coverage, Minimize Costs

Selecting the right health insurance plan is a balancing act between premium costs, deductibles, and out-of-pocket expenses. Here’s what to consider:

- Evaluate Your Health Needs: Look back on the past year. Did you have many doctor visits or high medical costs? One of the things I am changing in our benefits this year is switching to a high deductible health plan. We rarely went to the doctor this year and every family member is “fairly healthy”. By switching insurance, this lowers down our premiums and also allows us to open a Health Savings Account. READ how to use HSA for retirement

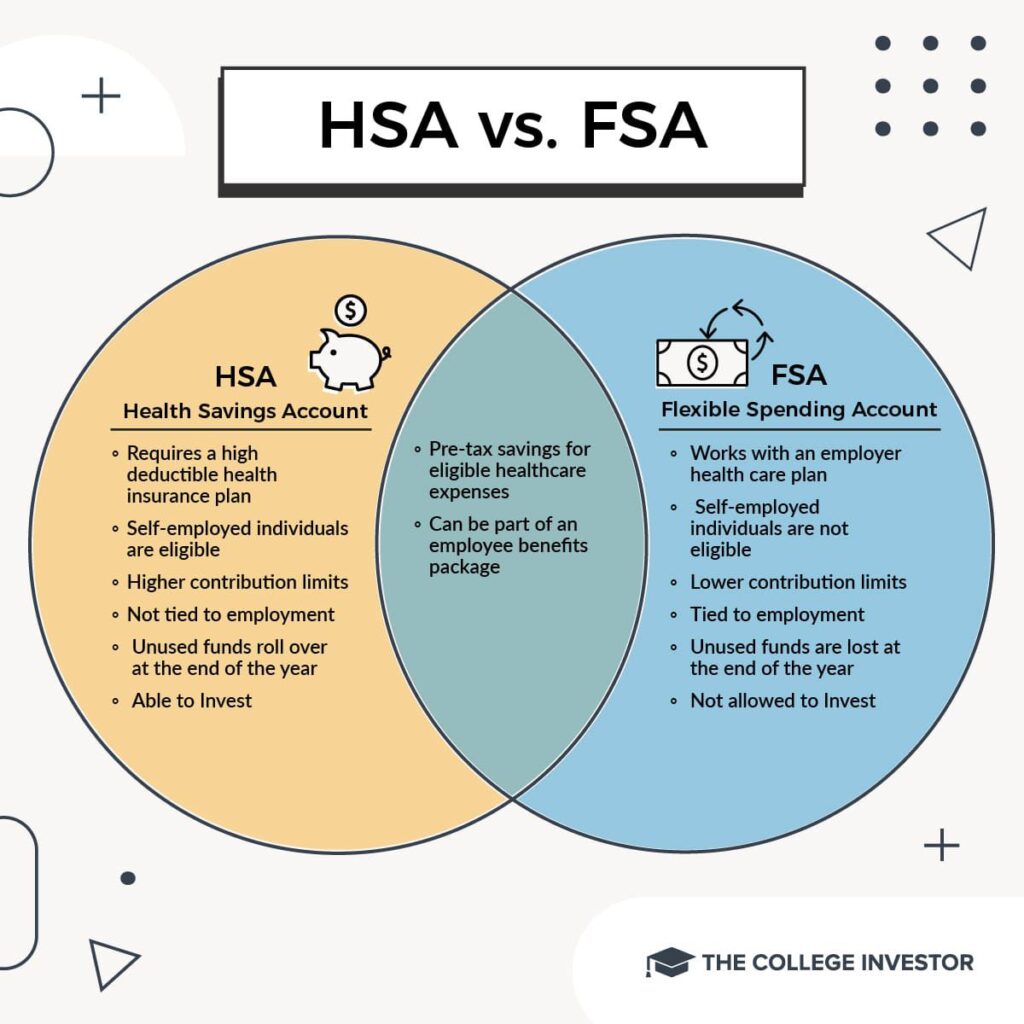

- Health Savings Accounts (HSA): If you opt for a high-deductible plan, consider maximizing contributions to an HSA. HSAs offer a triple tax advantage—your contributions, earnings, and withdrawals (for medical expenses) are tax-free. It’s a powerful savings tool that can grow over time and even be used as an additional retirement fund.

- READ MORE: How Health Insurance Works

3. Flexible Spending Accounts (FSA): Tax Savings on Health and Childcare

If your employer offers an FSA, take advantage of it to cover healthcare expenses or dependent care. FSAs allow you to set aside pre-tax dollars, reducing your taxable income. However, FSAs are “use-it-or-lose-it,” meaning you must spend the money within the plan year or forfeit it, so plan carefully.

4. Retirement Contributions: Maximize Employer Matching

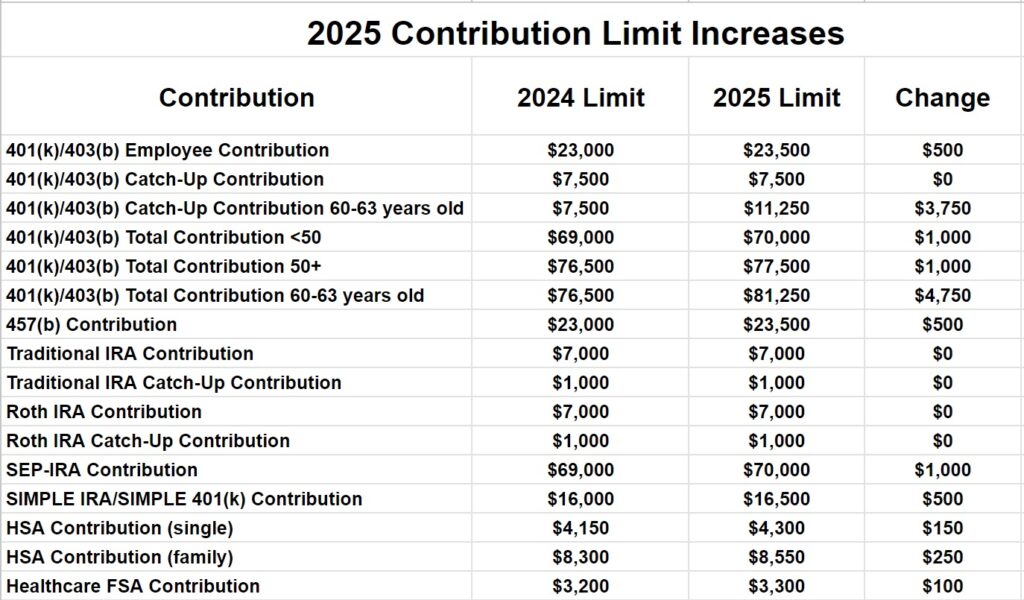

Open enrollment is also an ideal time to revisit your retirement contributions. Check to see if your employer offers a match on your 401(k) or 403(b) contributions. This is essentially “free money,” and you should contribute enough to get the full match if possible. If you haven’t adjusted your contributions in a while, consider increasing them. Even small increases can add up significantly over time, helping you reach your financial goals faster.

- 403(b) and 401(k) Contributions: As a nurse, you may have access to a 403(b) plan (for those working in non-profit healthcare organizations). Contributing to these tax-deferred accounts can lower your taxable income and allow your money to grow tax-free until you retire. Aim to increase your contribution each year, especially if you’re far from retirement.

- Catch-up Contributions: If you’re over 50, take advantage of the opportunity to make catch-up contributions. This allows you to save more each year and accelerate your journey toward financial freedom.

- Know the changes for maximum contributions for next year so you can plan ahead.

5. Life Insurance: Reassess Your Needs

If your employer offers life insurance, review the coverage you’re currently receiving. Many employers offer a basic policy, but it might not be enough to fully protect your loved ones. Consider opting for supplemental life insurance if you need additional coverage. Adequate life insurance is a key part of any financial freedom plan because it ensures that your family will be protected if something happens to you.

When it comes to life insurance, I recommend getting term life insurance vs whole life insurance. There are so many “financial advisors” who would advise you to get IUL/Whole life insurance and use it as an investment vehicle. There are a lot of caveats w/ getting whole life insurance and it has a place in your financial strategy.

Read: Whole Life Insurance is a Bad Investment: Debunking the Myths

6. Disability Insurance: Protect Your Income

Disability insurance can be a financial lifesaver if you’re unable to work due to illness or injury. If your employer offers long-term or short-term disability insurance, review the coverage carefully and opt for a plan that adequately protects your income. Nurses, in particular, face physical and mental demands, so having this safety net is crucial in maintaining financial stability.

7. Wellness Programs and Additional Benefits

Many employers are now offering wellness programs, mental health support, and financial wellness tools. Some of these perks can help you save money or provide you with resources to improve your physical and financial well-being. I just realized this year that my work provides discounts for gym memberships and therapy.

Take advantage of any programs that fit your goals, whether it’s reducing stress, boosting retirement savings, or accessing financial planning tools.

8. Review Your Beneficiaries

During open enrollment, take a few moments to ensure your beneficiaries are up-to-date. This applies to your life insurance, retirement accounts, and any other benefits that pass on to your loved ones if something happens to you. Ensuring that your beneficiaries are correct prevents delays and complications for your family in the future.

9. Get Professional Advice

If you’re unsure about how to best optimize your benefits during open enrollment, consider speaking to a financial advisor or benefits specialist who specializes in working with healthcare professionals. They can help you make informed decisions based on your current financial situation and your long-term goals for financial freedom.

Conclusion

Open enrollment is more than just a task to check off your list—it’s an opportunity to optimize your financial future. By making thoughtful decisions about your health insurance, retirement savings, and other benefits, you’re setting yourself up for long-term financial security. Take the time to understand your options, and remember that every smart choice brings you one step closer to the financial freedom you’re working hard to achieve.